The “Art” of Market Timing

Barry Ritholtz

NOVEMBER 27, 2023

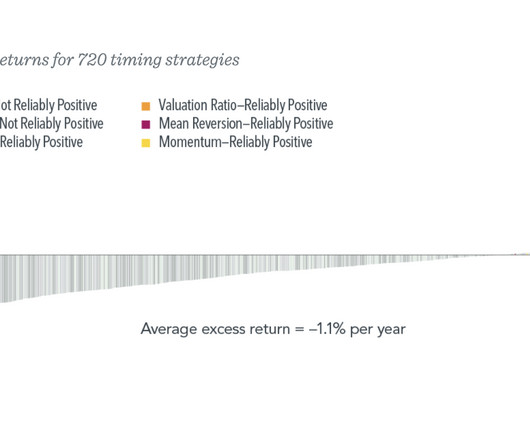

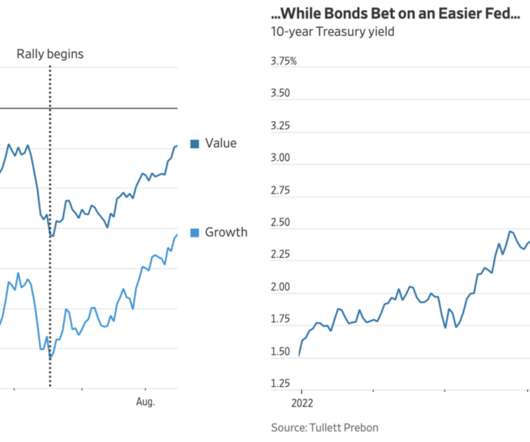

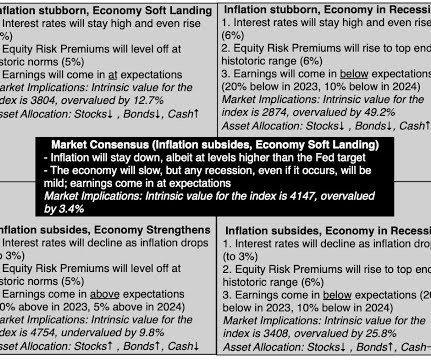

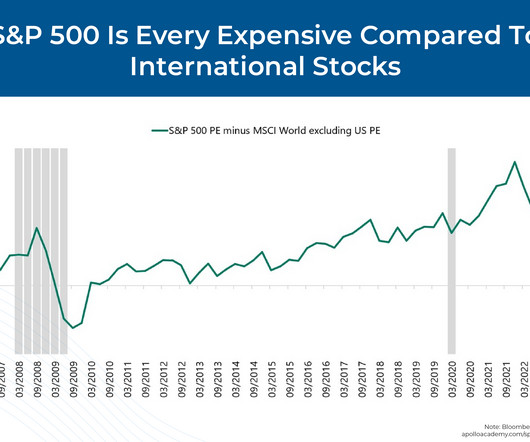

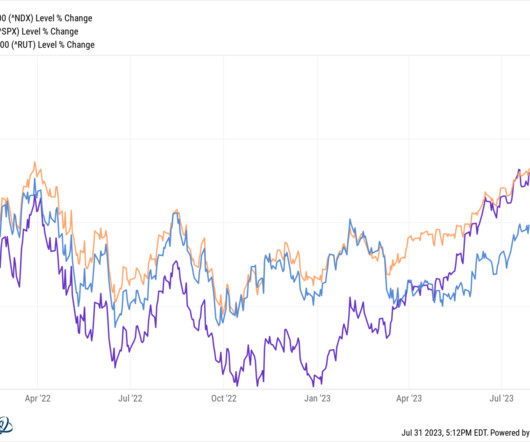

This weekend Jeff Sommer discussed a DFA research paper on market timing; both are well worth your time to read. The broad strokes are: Market timing is extremely difficult, very few people (if any) do it consistently well. Low Stakes : The most successful market timers are often those people who do not have actual assets at risk.

Let's personalize your content