17 Best Ways to Invest $2,000 to $3,000

CFO News Room

JANUARY 6, 2023

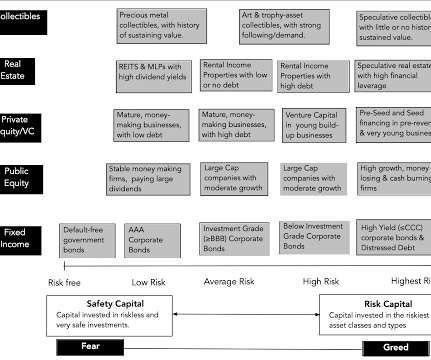

Having $2,000 to $3,000 to invest is a good feeling, but how you allocate those funds can impact your finances more than you might realize. Before you decide where to invest $2,000 to $3,000, think about when you’ll need the money. Before you decide where to invest $2,000 to $3,000, think about when you’ll need the money.

Let's personalize your content