The Problem Of High U.S. Equity Valuations And How Advisors Can Factor In Current Evaluations Risks

Nerd's Eye View

MARCH 6, 2024

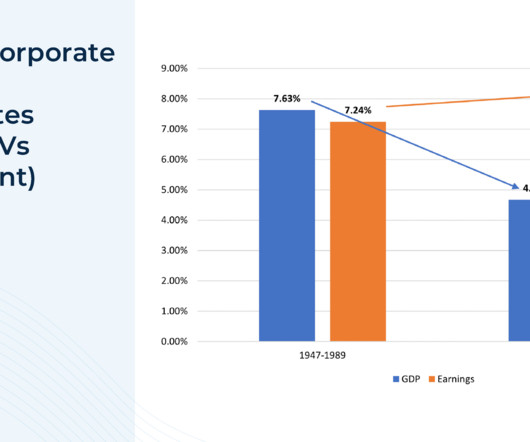

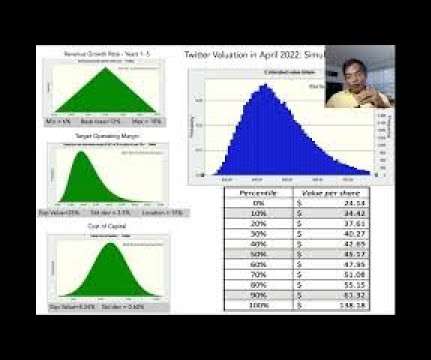

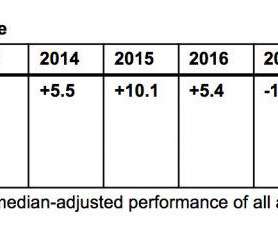

The Shilller Cyclically Adjusted Price-to-Earnings (CAPE 10) Ratio is one example that takes into account current market valuations versus company earnings, generally predicting that the higher the valuation at the beginning of a period the lower the expected return for that period. Read More.

Let's personalize your content