Avoid the Unforced Investment Errors Even Billionaires Make

Barry Ritholtz

APRIL 17, 2025

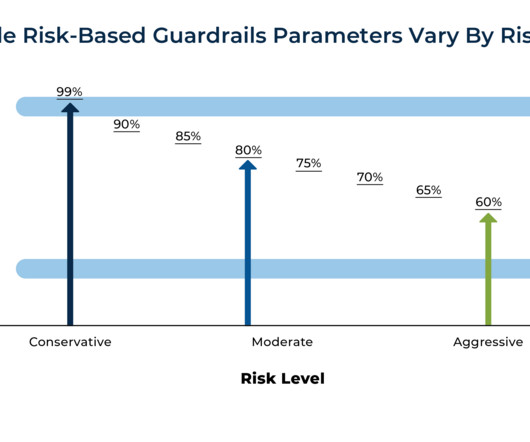

It doesnt matter if it is Nvidia, Bitcoin, founders stock, or an employee stock option purchase plan (ESOP), sometimes the sheer size of a windfall is paralyzing. These two possibilities a 10-fold increase versus a 90% drop are roughly symmetrical in terms of math (but probably not probabilities).

Let's personalize your content