Weekend Reading For Financial Planners (June 14–15)

Nerd's Eye View

JUNE 13, 2025

Other key findings from the survey included a gap between long-term investment return expectations of investors and advisors (12.6%

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Nerd's Eye View

JUNE 13, 2025

Other key findings from the survey included a gap between long-term investment return expectations of investors and advisors (12.6%

Nerd's Eye View

DECEMBER 27, 2024

Also in industry news this week: According to a recent survey, advisors are putting an increasing share of client assets into model portfolios, allowing for customization and time savings that advisors appear to be using to provide more comprehensive planning services RIA M&A deal volume saw an annual record in 2024 as a lower cost of capital, (..)

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

How To Overcome Change Fatigue In Finance With Neuroscience-Backed Strategies

From Curiosity to Competitive Edge: How Mid-Market CEOs Are Using AI to Scale Smarter

Protect What Matters: Rethinking Finance Ops In A Digital World

Why Tech-Forward Tax and Accounting Firms Have the Inside Track to the Future

Your Accounting Expertise Will Only Get You So Far: What Really Matters

CFO Talks

MAY 20, 2025

Playing the Global Tax Game Without Getting Burnt: What Every South African CFO Must Get Right Its no longer enough to know your way around a balance sheet. Todays CFO is the nerve centre of every strategic decision, from pricing to expansion, and increasingly, international tax planning. Get it right, and you unlock value.

How To Overcome Change Fatigue In Finance With Neuroscience-Backed Strategies

From Curiosity to Competitive Edge: How Mid-Market CEOs Are Using AI to Scale Smarter

Protect What Matters: Rethinking Finance Ops In A Digital World

Why Tech-Forward Tax and Accounting Firms Have the Inside Track to the Future

Your Accounting Expertise Will Only Get You So Far: What Really Matters

Nerd's Eye View

OCTOBER 14, 2022

Enjoy the current installment of “Weekend Reading For Financial Planners” - this week’s edition kicks off with the news that the Cost Of Living Adjustment (COLA) for Social Security beneficiaries will be 8.7% for 2023, the largest COLA since 1981. Why accounting firms have become hot acquisition targets for RIAs.

E78 Partners

MARCH 3, 2025

The IPO market has also seen a resurgence, with 13 IPOs each aiming to raise $100 million or more filed in January 2025 alone , marking the highest number of sizable IPO filings in a single month since early 2022. Develop Comprehensive Tax Strategies: Optimize tax planning, transfer pricing, and international tax considerations.

Nerd's Eye View

SEPTEMBER 20, 2024

Enjoy the current installment of "Weekend Reading For Financial Planners" – this week's edition kicks off with the news that the North American Securities Administrators Association (NASAA) released the latest edition its annual survey outlining the state of state-registered RIAs, showing that the number of state-registered firms and their assets (..)

Nerd's Eye View

DECEMBER 25, 2023

We start with several articles on retirement planning: Data showing where American retirees currently stand, from their average net worth to how they spend each hour of the day How, according to a recent study, delaying Social Security benefits typically leads to greater lifetime wealth than claiming benefits early in order to reduce portfolio withdrawals (..)

Nerd's Eye View

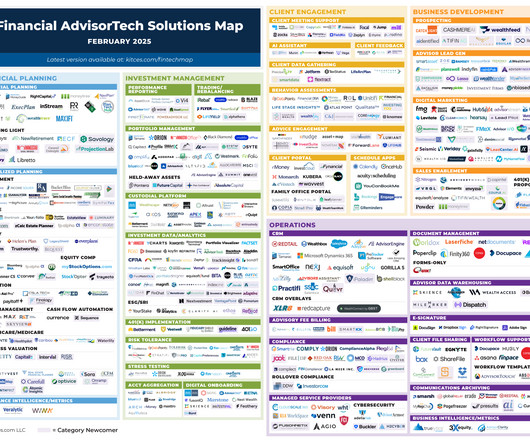

FEBRUARY 19, 2024

those that offer both digital robo-advice and human touch) are growing faster than almost everyone else, with 24% of net new cashflows despite the low aggregate number of firms with this business model. Likewise, while CRM usage has slipped by about 5%, the overall number of advisors who use a CRM still remains at a dominant 92%.

Nerd's Eye View

JULY 12, 2024

Which suggests that while firms might be tempted to zero in on compensation when it comes to retaining advisors, focusing on these other factors (which do not necessarily involve hard dollar expenses) could pay off in the form of increased advisor (and client) retention over time.

CFO News Room

DECEMBER 30, 2022

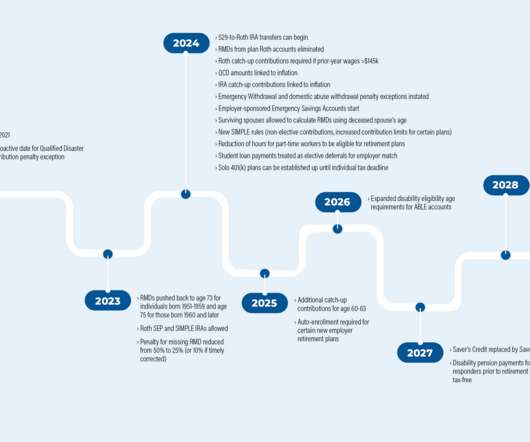

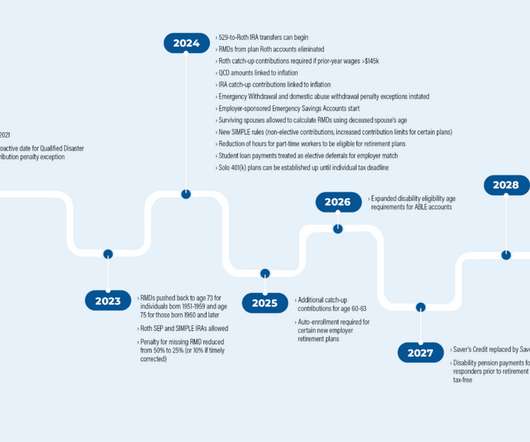

Enjoy the current installment of “Weekend Reading For Financial Planners” – this week’s edition kicks off with the news that the passage of “SECURE Act 2.0” has brought a wide range of changes to the world of retirement planning. In fact, while no single change in SECURE 2.0 In fact, while no single change in SECURE 2.0

CFO Plans

JUNE 14, 2024

In today’s AI-powered business environment, accounting is no longer just about crunching numbers. Cloud-based accounting software offers a seamless, efficient, and secure way to manage your finances. Success Story: A growing tech startup engaged virtual CFO services to navigate their financial planning and budgeting.

CFO Simplified

MARCH 7, 2024

The CTA and the disclosure obligations it imposes upon reporting companies is designed to help safeguard national security and provide US law enforcement agencies with an additional tool to fight financial crimes, such as money laundering, trafficking, tax fraud, and other illicit activities.

CFO Simplified

MARCH 7, 2024

The CTA and the disclosure obligations it imposes upon reporting companies is designed to help safeguard national security and provide US law enforcement agencies with an additional tool to fight financial crimes, such as money laundering, trafficking, tax fraud, and other illicit activities.

CFO News Room

DECEMBER 20, 2022

And one of the flyers that came out said that I did estate planning, and tax planning, and business succession planning, and all these things I didn’t know anything about. And so, ultimately, I… Michael: Not actually that deep on your business succession planning experience as a 20-year-old.

CFO News Room

NOVEMBER 29, 2022

And so, that’s how this actually started was, at first, I knew I wanted to just get a deeper dive into our numbers, into our business, our process, and, so, I engaged in the CFO solutions services. So, we do look at clients from the complexity of what type of planning they have. ” That’s what we did.

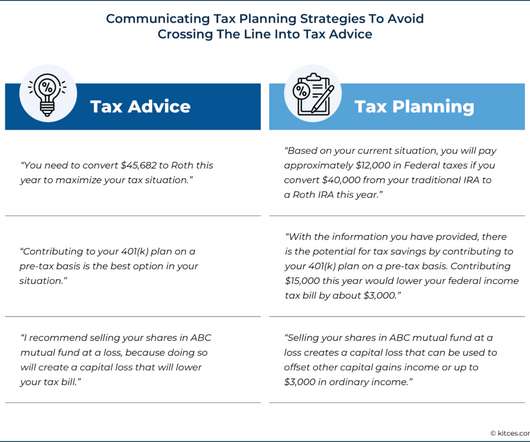

CFO News Room

NOVEMBER 30, 2022

And the consequences for incorrect tax advice can include legal and financial penalties if a client were to be harmed by the wrong advice – which is often not covered by the firm’s E&O insurance –creating an expensive liability when tax advice goes wrong. Might be a source of tax-free income ( unless the IRS says otherwise )!

CFO News Room

FEBRUARY 2, 2022

Estate planning is commonly a big point of discussion, as well. And for most advisors that takes us down a road of tax planning and lots of different types of trusts and family limited partnerships and GRATs and IDGTs and all the different strategies that are out there, or at least as long as Congress lets us keep playing those games. .”

Future CFO

SEPTEMBER 14, 2020

Paper-based processes became obsolete and secure access to standalone applications posed technical challenges. The truth of the matter is that COVID-19 is exposing gaps in current financial planning across the region. For example, Lee noted that before the pandemic, the hospitality business was forecasted around the number of flights.

Nerd's Eye View

DECEMBER 28, 2022

The Setting Every Community Up for Retirement Enhancement (SECURE) Act, passed in December 2019, brought a wide range of changes to the retirement planning landscape, from the death of the ‘stretch’ IRA to raising the age for Required Minimum Distributions (RMDs) to 72. In addition, SECURE 2.0

Nerd's Eye View

DECEMBER 28, 2022

The Setting Every Community Up for Retirement Enhancement (SECURE) Act, passed in December 2019, brought a wide range of changes to the retirement planning landscape, from the death of the ‘stretch’ IRA to raising the age for Required Minimum Distributions (RMDs) to 72. In addition, SECURE 2.0

Barry Ritholtz

AUGUST 15, 2023

Or at least the top, pick a number, 30, 40%. I don’t remember the number. SEIDES: No, you’re right about the securities. SEIDES: It wasn’t a question of security prices going down, it’s a question of like, can you transact? So you’re talking about an average of a large number.

CFO News Room

DECEMBER 23, 2022

Enjoy the current installment of “Weekend Reading For Financial Planners” – this week’s edition kicks off with the news that Congress appears poised to pass “SECURE Act 2.0”, a series of measures that will have significant impacts on the world of retirement planning. And notably, while no single change in SECURE 2.0

CFO News Room

NOVEMBER 28, 2022

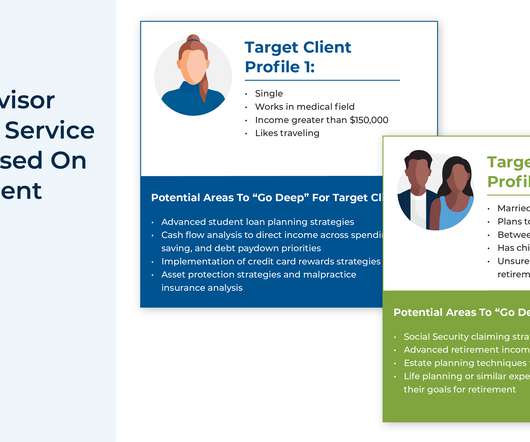

Combined with growing advisor (and consumer) interest in comprehensive financial planning services, the number of ways advisors can add value for their clients has expanded greatly. Luckily, advisors have a large number of ways to add value to their clients’ lives (more than 101 in fact!) Tax Planning.

Nerd's Eye View

JANUARY 31, 2024

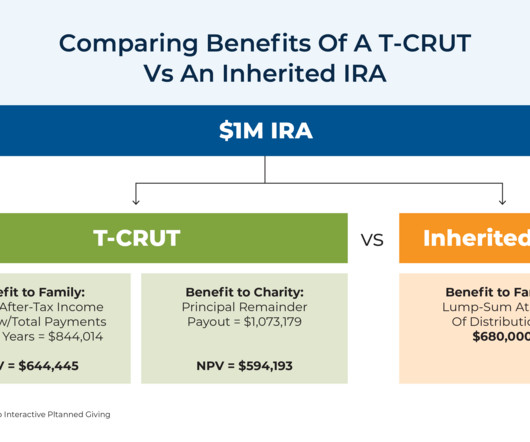

In late 2019, Congress passed the Setting Every Community Up for Retirement Enhancement (SECURE) Act, introducing several significant changes to retirement planning. This shift has led financial advisors to explore new strategies for mitigating the resulting tax-planning challenges.

CFO News Room

NOVEMBER 19, 2022

From there, we have several articles on tax planning: How advisors can add value for their clients by managing their exposure to mutual fund capital gains distributions. A new research study suggests that delaying taxes in retirement is often not the optimal course of action. While SECURE 2.0

CFO News Room

DECEMBER 26, 2022

As 2022 comes to a close, I am once again so thankful to all of you, the ever-growing number of readers who continue to regularly visit this Nerd’s Eye View Blog (and share the content with your friends and colleagues, which we greatly appreciate!). Executive Summary.

Nerd's Eye View

MARCH 15, 2024

While the final submitted text has not been released, some experts suggest that the DoL likely made few changes to its initial proposal, despite significant opposition from broker-dealers that could lead to the judicial system deciding the rule’s ultimate fate.

CFO News Room

NOVEMBER 15, 2022

And that’s what they get for the fact that they have to be part of the calls, they have to facilitate interaction with the insurance company or any transactions, because it’s a securities business, you don’t have a securities license now. There was no repapering of accounts, clients didn’t get new account numbers.

CFO News Room

FEBRUARY 2, 2022

Number one is just the fact that we have multiple fee structures. So, that’s number one. So, obviously, those are kind of round numbers that they just input. All right, those are very good numbers. Now, that number is really hard to quantify for a couple of reasons. Michael: Sure, sure.

Barry Ritholtz

OCTOBER 19, 2022

RAMPULLA: I went to Drexel part time while I was at Vanguard, did that commute down to Philadelphia from the suburbs, you know, three times a week for a number of years. I was employee number one in London. So there’s the, “Hey, I’ll work with you and we’ll develop goals and a plan how to get there.”

CFO News Room

DECEMBER 17, 2022

How firms can best leverage their internal data to improve the number of client referrals they receive. We also have a number of articles on retirement planning: While weak stock and bond market performance has challenged advisors and their clients this year, these trends have likely increased the ‘safe’ withdrawal rate for new retirees.

Nerd's Eye View

MARCH 15, 2024

While the final submitted text has not been released, some experts suggest that the DoL likely made few changes to its initial proposal, despite significant opposition from broker-dealers that could lead to the judicial system deciding the rule’s ultimate fate.

CFO News Room

NOVEMBER 8, 2022

And the four pillars are the financial plan, risk management, so just checking all their what-if scenarios that something…a husband dies, wife dies, long-term care, disability. And then we look at estate planning. And then in the fall, we look at tax planning. And so, that can move the numbers, as well.

CFO News Room

DECEMBER 28, 2022

The Setting Every Community Up for Retirement Enhancement (SECURE) Act, passed in December 2019, brought a wide range of changes to the retirement planning landscape, from the death of the ‘stretch’ IRA to raising the age for Required Minimum Distributions (RMDs) to 72. In addition, SECURE 2.0 Executive Summary.

Nerd's Eye View

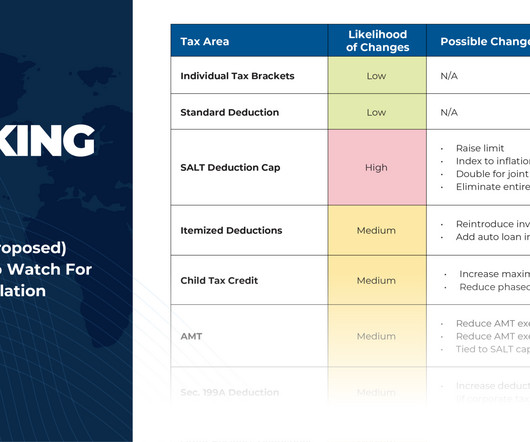

NOVEMBER 13, 2024

With Republicans appearing to have secured a sweep of the White House and both chambers of Congress, the most immediate question for many financial advisors and their clients is what impact the election results will have on the scheduled expiration of the Tax Cuts & Jobs Act (TCJA) at the end of 2025. Read More.

Nerd's Eye View

FEBRUARY 3, 2025

This month's edition kicks off with the news that FP Alpha has released its tax return extraction and analysis module as a standalone product, while RightCapital has separately launched its own tax return extraction tool bundled within its platform – with both announcements coming on the heels of Holistiplan implementing a significant price increase, (..)

CFO News Room

NOVEMBER 26, 2022

We also have a number of articles on retirement planning: How advisors can incorporate Social Security benefits into a client’s retirement asset allocation. The end of the year is often a busy time for financial advisors, as they help clients with year-end tax planning, taking the proper RMDs, and other time-sensitive tasks.

CFO Share

SEPTEMBER 15, 2021

Moreover, S-corps and pass-through companies are facing tax increases too…. Elimination of pass-through tax deductions. If you are a high-income S-corp, partnership, or sole proprietor, the proposed tax plan will eliminate your Qualified Business Income Deduction , commonly referred to as the pass-through deduction.

PYMNTS

FEBRUARY 1, 2021

Former President Donald Trump was against the potential tax plans, contending that they discriminated against U.S. The Center for Secure and Trusted Machine Learning, part of the Viterbi School of Engineering at the University of Southern California (USC), will back research that examines methods to secure and safeguard privacy in ML.

Barry Ritholtz

OCTOBER 3, 2023

If you look at the, if you look at the filing and you look at the size of the company and the revenue, the entire yearly revenue numbers would be a bad quarter right? So then we decided, look, look, maybe we should put all of these businesses together and create a securities division. We now had the securities business.

CFO News Room

JANUARY 24, 2023

In a note to me, Hauser summed up the case against Zients: ‘Biden at his best has picked battles with corporate America, from the tax plan funding the IRA to appointing regulators like Rohit Chopra, Gary Gensler, and Lina Khan to take on predatory behavior. Still, WHO says it doesn’t see a need to distinguish between them.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content