Valuation and Corporate Governance Consequences

CFO News Room

JANUARY 15, 2023

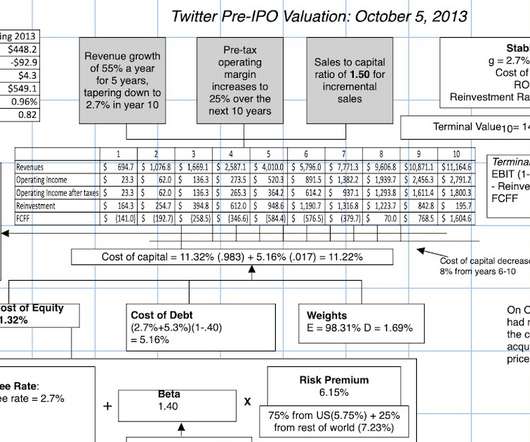

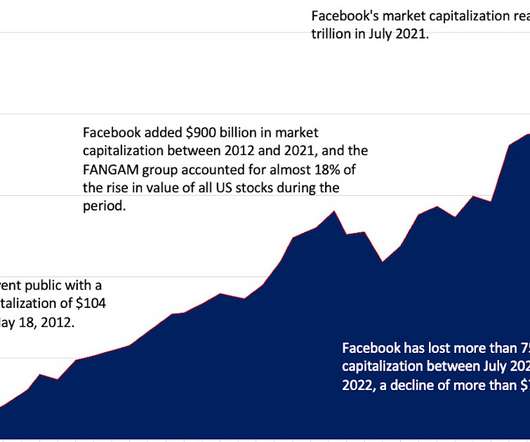

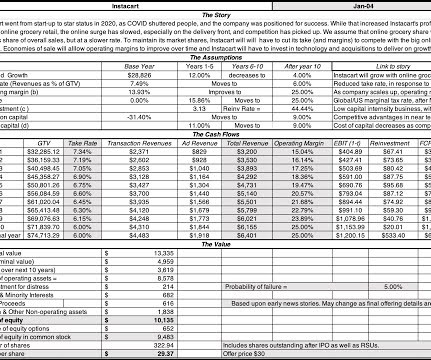

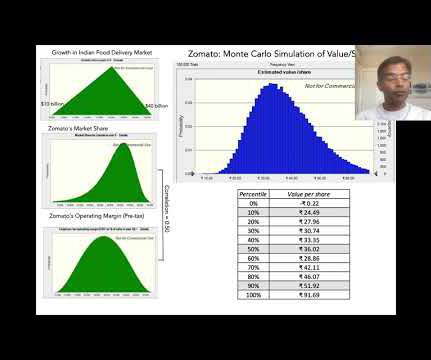

billion I estimated in 2021 (year 8 in my IPO valuation) as revenues in my IPO valuation of the company in November 2013, and its operating margin, even with generous assumptions on R&D, was 19.02% in 2021, still below my estimate of 19.76% in that year. . The Twitter Story. billion, well below the $9.6

Let's personalize your content