Treasury professionals: The hardest-to-manage risks

Future CFO

SEPTEMBER 26, 2023

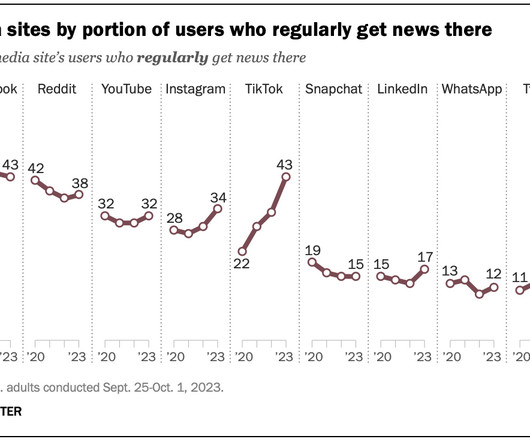

Treasury professionals see macroeconomic risk as one of the hardest to manage. According to Association For Financial Professionals’ 2023 AFP Risk Survey, 43% of treasury professionals consider macroeconomic risk —the pace of GDP growth, inflation and interest rates —to be one of the most challenging risks to manage.

Let's personalize your content