The Problem Of High U.S. Equity Valuations And How Advisors Can Factor In Current Evaluations Risks

Nerd's Eye View

MARCH 6, 2024

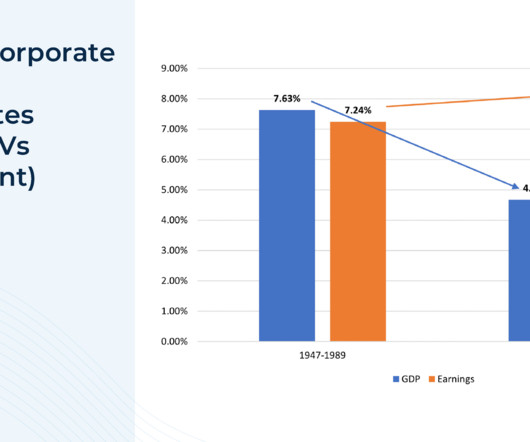

One way to predict future market returns is to use the past as a guide, with nearly 100 years of continuous market data since the 1920s covering a wide range of economic conditions showing that, for instance, the S&P 500 has had nearly a 10% average compounding return (7% above inflation) since 1926.

Let's personalize your content