CFOs zero in on digital transformation

CFO Dive

JANUARY 13, 2023

Finance leaders are still prioritizing digital transformation even as they face economic headwinds.

CFO Dive

JANUARY 13, 2023

Finance leaders are still prioritizing digital transformation even as they face economic headwinds.

Navigator SAP

JANUARY 13, 2023

One reason that businesses move to ERP is for intelligent process automation. But this can be a nebulous term, often combined with vague buzzwords such as automated robotic processing, machine learning and artificial intelligence.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

CFO Dive

JANUARY 13, 2023

The former CFO of GigaTrust faces a maximum sentence of five years in prison for his role in a conspiracy to defraud investors and lenders, including by fabricating bank statements.

Barry Ritholtz

JANUARY 13, 2023

It may surprise you to learn that during this cycle of falling inflation, there seems to be little correlation with rising Fed Rates. This is very counter-intuitive but it makes sense when you consider what an aberrational and unusual cycle this has been. Despite zero rates for a decade plus inflation was quite benign. it was only the combination of the global pandemic and lockdown, a massive fiscal stimulus, and a surge in demand for goods that have driven the 2020 to 2022 inflation.

Speaker: Joe Wroblewski, Sales Engineer Manager

Automating time-consuming manual tasks can save your firm hundreds of hours–and thousands of dollars. But it can also have longer-lasting benefits, like helping you attract and retain the next generation of CPAs, and we don’t need to tell you how important that is amid the current generational staffing crisis in the tax and accounting profession. You'll want to save your seat for this new webinar with industry expert Joe Wroblewski, where we'll explore how to: Maximize ROI with Cost-Effective Te

CFO Dive

JANUARY 13, 2023

Audit committees are taking on more responsibilities as the SEC writes several rules requiring more detailed corporate disclosure.

Corporate Finance Brief brings together the best content for corporate finance professionals from the widest variety of industry thought leaders.

Navigator SAP

JANUARY 13, 2023

Whenever medium-sized businesses compete, chances are that there will be numerous big businesses able to stay ahead of the curve due to their size, budget, and history in the marketplace. The way for smaller businesses to outcompete the big guys is to streamline their operations and provide higher quality services at competitive prices.

CFO News Room

JANUARY 13, 2023

Even if you overcame financial issues caused by the pandemic, the last few years have made it difficult to “get ahead.” The statistics show that time and time again, consumers are struggling to make ends meet due to much higher prices across the board. A recent report by PYMNTS and LendingClub showed that 60% of American consumers have had to cut spending due to high inflation over the last 12 months.

CFA Institute

JANUARY 13, 2023

To be “as rich as an Argentine” was once a common aspiration. What happened?

CFO News Room

JANUARY 13, 2023

Enjoy the current installment of “Weekend Reading For Financial Planners” – this week’s edition kicks off with the news that the Federal Trade Commission has proposed a nationwide ban on noncompete clauses in employee contracts, aiming to give employees more freedom to change jobs within the same industry. In the advisor world, where noncompete agreements are fairly common, a ban on the practice could incentivize firms to reassess their employee value proposition and to consider ways to es

Advertisement

Automation generally supercharges any process and brings its value to the forefront. See how infusing automation such as ART (our month-end close solution), into your close can get you to the next level of closing. We will share a live demo of SkyStem's solution, ART and share the key elements of month-end close automation. Through ART, we'll take a look at: What month-end close automation entails Which process steps can and should be automated Benefits of achieving process automation, and Why i

CFA Institute

JANUARY 13, 2023

After a down year for financial markets, investors’ priorities have naturally shifted from growing their assets to preserving their wealth. While risk management may be the key component of wealth preservation, what often gets overlooked is how much smart tax planning can do to help clients retain more of their wealth. Clients stay loyal to […].

CFO News Room

JANUARY 13, 2023

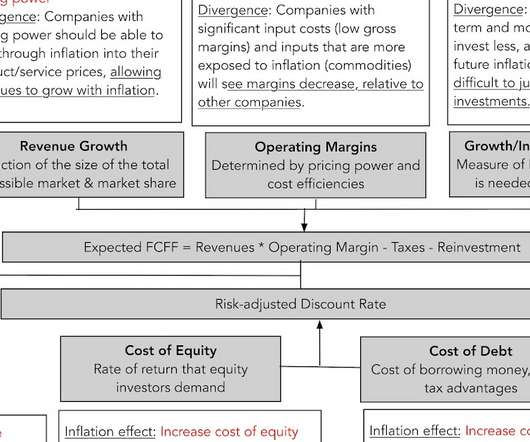

In my last post , I discussed how inflation’s return has changed the calculus for investors, looking at how inflation affects returns on different asset classes, and tracing out the consequences for equity values, in the aggregate. In general, higher and more volatile inflation has negative effects on all financial assets, from stocks to corporate bonds to treasury bonds, and neutral to positive effects on gold, collectibles and real assets.

Barry Ritholtz

JANUARY 13, 2023

My Friday the 13th, end-of-week morning train WFH reads: • F@*$#*! 2022 was a record year for earnings call swearing : The “polycrisis” of runaway inflation, pandemics, interest rate increases, supply chain snafus and wars helped lift swearing on earnings calls and investor days to a new record high in 2022. Good job everyone. ( Financial Times Alphaville ). • Elon Musk Might Never Be the World’s Richest Person Again : It’s not just that he became the first person in history to have $200 billion

CFO News Room

JANUARY 13, 2023

The crisis of low pay is widespread throughout the United States and will remain so until federal and state policymakers prioritize the economic hardships of low-wage workers. Even after the rapid inflation of the past 18 months and the recent unprecedented wage growth for lower-wage workers, 21 million workers are still paid less than $15 per hour.

Advertiser: Paycor

Mid-year performance reviews aren’t just boxes for HR to check. Paycor’s toolkit empowers leaders to: Identify high-potential team members. Boost engagement with meaningful feedback. Support struggling employees. Nurture top talent to drive results. Learn how to ignite employee potential through meaningful feedback. When you nurture top talent, everybody wins.

CFO News

JANUARY 13, 2023

Rate rises could add $8.

CFO News Room

JANUARY 13, 2023

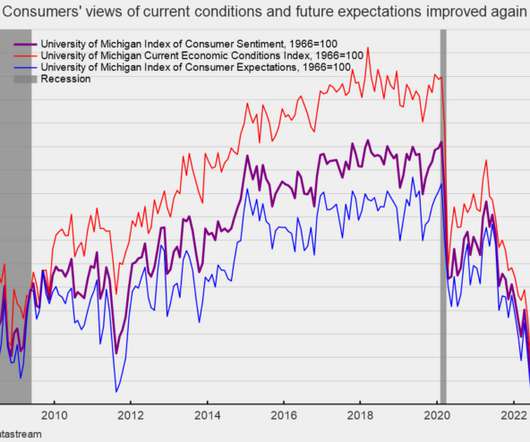

The preliminary January results from the University of Michigan Surveys of Consumers show overall consumer sentiment improved for the month but remains low (see first chart). The composite consumer sentiment index increased to 64.6 in January, up from 59.7 in December. The index hit a record low of 50.0 in June and is down from 101.0 in February 2020 at the onset of the lockdown recession.

The Reformed Broker

JANUARY 13, 2023

Welcome to the latest episode of The Compound & Friends. This week, Michael Batnick, Callie Cox, and Downtown Josh Brown discuss discuss the latest CPI data, why Michael’s feeling a little bullish, calling the Fed’s bluff, chances of a soft landing, retail investor sentiment, and much more! You can listen to the whole thing below, or find it wherever you like to listen to your favorite pods!

CFO News Room

JANUARY 13, 2023

A sign is posted in front of a Wendy’s restaurant on August 10, 2022 in Petaluma, California. Justin Sullivan | Getty Images. Check out the companies making headlines in midday trading. JPMorgan – Shares of the biggest U.S. bank by assets rose more than 2% after the firm posted fourth-quarter profit and revenue that topped expectations. The New York-based bank said profit jumped 6% from the year earlier period to $11.01 billion, or $3.57 per share.

Speaker: Victor C. Barnes, CPA, MBA

In the climb from contributor to leader, the rules quietly change. If you’re aiming for the summit, the air gets thinner—and what got you here won’t be enough to get you to the top (a concept first popularized by Marshall Goldsmith in his book What Got You Here Won’t Get You There ). What made you successful early in your finance career—technical accuracy, sharp analysis, flawless execution—won’t be what carries you to the next level.

Jedox Finance

JANUARY 13, 2023

These 12 sales trends serve as a roadmap for sales leaders looking to cultivate a more adaptable and integrated organization that evolves with today’s sophisticated buyers. Table of Contents. 1. Upskilling to build hybrid relationships. 2. Learning B2C practices. 3. Capturing value from data. 4. Differentiating through value. 5. Sales and marketing partnership. 6.

CFO News Room

JANUARY 13, 2023

How do you make a small fortune? Start with a large one and open a restaurant. The difficulties of running a U.S. eatery, whether selling hot dogs or haute cuisine, are well known, yet hope continues to triumph over experience. In a country saturated with chains, NPD Group estimates that about 53% of restaurants are still independent, despite their high failure rate—especially in the first year.

Nerd's Eye View

JANUARY 13, 2023

Enjoy the current installment of “Weekend Reading For Financial Planners” - this week’s edition kicks off with the news that the Federal Trade Commission has proposed a nationwide ban on noncompete clauses in employee contracts, aiming to give employees more freedom to change jobs within the same industry. In the advisor world, where noncompete agreements are fairly common, a ban on the practice could incentivize firms to reassess their employee value proposition and to conside

Bramasol

JANUARY 13, 2023

This new episode in our ongoing series on the Digital Solutions Economy (DSE) provides an overview of how DSE is impacting the Telecom industry. Previous episodes in this series include: DSE in the Media and Entertainment industry. DSE in the Semiconductor Industry. DSE in the Medical Device industry. DSE in Utilities industry. DSE in the Energy Sector.

Speaker: Kim Beynon, CPA, CGMA, PMP

The most overlooked, yet most critical, element of transformation is preparing people for change. Automation and AI aren't just technical upgrades, they’re cultural shifts which can challenge identities. That’s why change management isn’t a side project—it’s the foundation. In finance, where precision and process rule, navigating change can feel especially disruptive.

Tips Watch

JANUARY 13, 2023

Historical evidence clearly shows non-seasonal inflation lags from October to December, picks up from January to March. By David Enna, Tipswatch.

CFO News

JANUARY 13, 2023

Slowing inflation has prompted several economists to forecast an imminent end to the US Federal Reserve's rate-tightening cycle, hauling Wall Street indices from 52-week lows. Lately, the technology-heavy Nasdaq, the stock gauge most battered by Fed's liquidity drainage, has climbed about 8% from lows on expectations of a pause in the rate cycle by the summer.

Financial Analyst Insider

JANUARY 13, 2023

Today, many people talk about the energy of flowers. Truly magical qualities are attributed to this miraculous power: it can calm, tune in a positive. The post Why You Might Want The Energy of Flowers in The Workplace appeared first on Financial Analyst Insider.

CFO News

JANUARY 13, 2023

Industry executives and experts said section 15 of the IGST Act, 2017 provides for the Tax Refund for Tourists scheme but it has yet to be implemented. The issue has been taken up collectively by industry associations ahead of the Union budget for 2023-24, said Jyoti Mayal, vice chairperson, Federation of Associations for Indian Tourism and Hospitality.

Speaker: Mark Gilham, FCCA, CPP

Finance used to be the function that counted, now it's the one that’s counted on. 📊 For accounting firms, controllers, and finance leaders, expectations are rising faster than headcount. Businesses want agile forecasts, granular analysis, seamless reporting, and smart automation—often without added resources while demanding uncompromised accuracy and compliance.

Let's personalize your content