How Advisors Can Offer Tax Planning And Stay In Compliance

CFO News Room

NOVEMBER 30, 2022

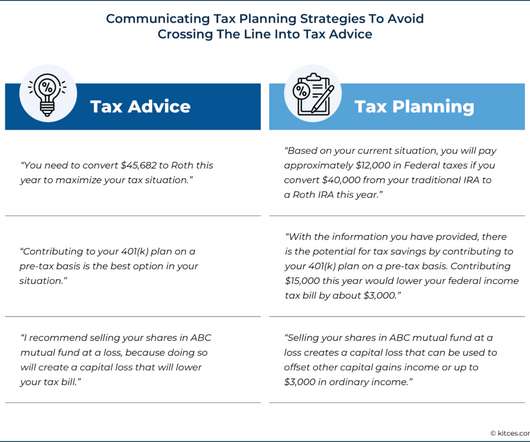

And the consequences for incorrect tax advice can include legal and financial penalties if a client were to be harmed by the wrong advice – which is often not covered by the firm’s E&O insurance –creating an expensive liability when tax advice goes wrong.

Let's personalize your content