FASB shifts to prioritize 'rapidly evolving' crypto assets

CFO Dive

MAY 12, 2022

The board is getting serious about improving accounting standards for digital assets even as a crypto market slump is hammering valuations.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

CFO Dive

MAY 12, 2022

The board is getting serious about improving accounting standards for digital assets even as a crypto market slump is hammering valuations.

Global Finance

JUNE 6, 2025

Global Finance : To what extent does geography play a role in affecting a company’s valuation? There’s no inherent valuation. From a corporate valuation perspective, they’re not particularly interesting. GF: Are there certain basic mistakes that happen at a company that hurts valuation or leads to their failure?

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

How To Overcome Change Fatigue In Finance With Neuroscience-Backed Strategies

From Curiosity to Competitive Edge: How Mid-Market CEOs Are Using AI to Scale Smarter

Protect What Matters: Rethinking Finance Ops In A Digital World

Why Tech-Forward Tax and Accounting Firms Have the Inside Track to the Future

Your Accounting Expertise Will Only Get You So Far: What Really Matters

Private Funds CFO

FEBRUARY 1, 2022

Labor and supply-chain costs pose the biggest short-term risks to corporate valuations, despite worries that the Fed may raise rates, market professionals say.

How To Overcome Change Fatigue In Finance With Neuroscience-Backed Strategies

From Curiosity to Competitive Edge: How Mid-Market CEOs Are Using AI to Scale Smarter

Protect What Matters: Rethinking Finance Ops In A Digital World

Why Tech-Forward Tax and Accounting Firms Have the Inside Track to the Future

Your Accounting Expertise Will Only Get You So Far: What Really Matters

E78 Partners

MARCH 18, 2025

This trend is echoed in similar PE outlooks , emphasizing that rate cuts from 2024 highs have spurred improved valuations and renewed investor confidence. as firms held back from divesting in hopes of stronger valuations in 2025. Overall, deal value climbed 10.3% This urgency aligns with observations from Bain & Co.

E78 Partners

MAY 14, 2025

Technology is reshaping private equity (PE) by enabling portfolio companies to achieve operational efficiency, revenue growth, and higher valuations. Developing seamless integration plans, including data migration and system harmonization, ensure operational continuity and scalability, which are vital for commanding premium valuations.

E78 Partners

MARCH 19, 2025

This trend is echoed in similar PE outlooks , emphasizing that rate cuts from 2024 highs have spurred improved valuations and renewed investor confidence. as firms held back from divesting in hopes of stronger valuations in 2025. Overall, deal value climbed 10.3% While fundraising fell 18.5%

CFO News

MAY 5, 2025

The company prioritizes ensuring proper valuation and optimal timing for maximum synergy. LG Electronics is delaying its planned 15,000-crore IPO for its Indian entity due to volatile market conditions and macroeconomic uncertainty.

E78 Partners

JUNE 12, 2025

In today’s competitive and high-cost market, sponsors rely on margin expansion to drive higher valuations and prepare portfolio companies for exit. Firms that prioritize this from the outset build more resilient, scalable operations. Private equity firms that prioritize execution, not just strategy, see stronger outcomes.

CFO Thought Leader

DECEMBER 2, 2024

Over two decades, he honed his expertise in mergers and acquisitions, valuation, and strategic advisory, collaborating with CFOs on transformative deals. “My advice to aspiring CFOs is to always prioritize teamwork and empowering your people. In 2006, Lam relocated to New York to lead KPMG’s global TMT corporate finance team.

E78 Partners

MARCH 28, 2025

Prioritizing these areas isnt just smartits essential to thrive in an increasingly competitive environment. LPs are increasingly prioritizing Multiple of Invested Capital (MOIC) alongside internal rate of return (IRR). years, the longest since 2005 ( McKinsey & Company ). years, the longest since 2005 ( McKinsey & Company ).

CFO Strategic Partners

MARCH 22, 2025

Prioritize Clean, Integrated Data – If your data still resides in multiple systems that can’t talk to each other, you won’t be able to generate reports and insights efficiently. Invest in tech where it can deliver measurable value and look for chances to automate and standardize.

Nerd's Eye View

OCTOBER 4, 2024

Also in industry news this week: A recent survey found that while 1/3 of advisory firms are currently using AI tools, another 1/3 are fearful of doing so, indicating that while some firms are eager to be early adopters of this technology, others are taking a wait-and-see approach, perhaps as regulation surrounding this technology evolves over time (..)

CFO Strategic Partners

APRIL 14, 2025

5 Reasons to Prioritize Financial Literacy Poor financial literacy negatively impacts overall business performance, financial decision-making, fundraising, M&A, and much more. They will also consider EBITDA to determine valuation and assess the financial health of your company.

Musings on Markets

SEPTEMBER 1, 2021

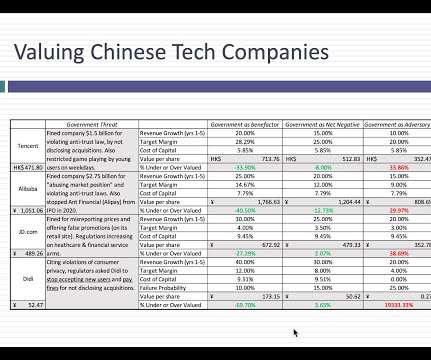

Chinese Tech Plays - Valuation Stories To value the Chinese tech companies, I have to construct valuation stories that fit them, and as you can see there are big differences across the four companies (Tencent, Alibaba, JD.com and Didi) not only in where they are in terms of growth potential, but also in terms of profitability and business models.

Centage

SEPTEMBER 5, 2023

With more shoppers prioritizing necessities, businesses increasingly have to make adjustments to stay in the black. Four: Understand Customer Valuation Your customers are the source of your revenue – and your profits. A low valuation customer who typically purchases high margin items later on is a good investment.

Global Finance

APRIL 5, 2025

The transaction supports Iberdrolas focus on electricity grids as the continent increasingly prioritizes grid resilience and modernization. billion valuation. Also in Europe, the Spanish multinational electric-utility company Iberdrola acquired an 88% stake in the UKs Electricity North West for 2.5 billion (about $2.7

Musings on Markets

OCTOBER 4, 2021

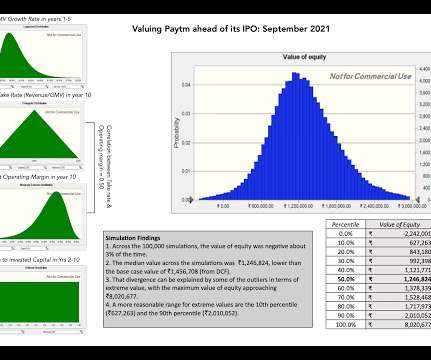

In this post, I will look at the levers that drive Paytm's value, and you can make your judgments on where you think this offering will lead in terms of valuation and pricing. I know that there are many on both sides of the value divide who will disagree with me on my story and valuation, and that is par for the course.

VCFO

MAY 17, 2024

How can you be sure the decisions you are making are taking valuation in the right direction? These measures are examined in the strategic context of your business and market(s) to help you prioritize more effectively and accelerate impact. You don’t want to be good enough – you want to be your best.

Centage

APRIL 4, 2023

With more shoppers prioritizing necessities, businesses increasingly have to make adjustments to stay in the black. A low valuation customer who typically later purchases high margin items is a good investment. Are you spending like crazy to acquire new customers? But you need to understand which is which.

E78 Partners

JANUARY 5, 2024

Engage Third Parties Early: Engage valuation firms and appraisers early in the process, as these experts can help support audit preparation and reduce hassles later on. Additionally, remember to tackle valuation early and reach out to auditors for guidance on non-recurring or unusual transactions.

PYMNTS

JANUARY 27, 2020

We like their laser focus on treating cities as their number 1 customer and their mindset of prioritizing profitability over growth.”. In October, news surfaced that Bird had announced a Series D funding round of $275 million bringing its valuation to $2.5 Circ is a top shared eScooter company in the Middle East and Europe.

PYMNTS

JANUARY 27, 2020

We like their laser focus on treating cities as their number 1 customer and their mindset of prioritizing profitability over growth.”. In October, news surfaced that Bird had announced a Series D funding round of $275 million bringing its valuation to $2.5 Circ is a top shared eScooter company in the Middle East and Europe.

CFO Strategic Partners

APRIL 14, 2025

Prioritize Recognition and Appreciation – Acknowledge the contributions of team members in tangible ways to help them develop a sense of worth in the organization. Here are five ways to infuse those values into your culture. A culture of appreciation that celebrates big and small achievements helps individuals feel seen and valued.

PYMNTS

JULY 24, 2019

After a year of research and conversations with thousands of Dashers, we built a pay model to prioritize transparency and consistency of earnings, and to ensure all customers get their food as fast as possible, ” Xu said on Twitter. This followed a $400 million investment at a valuation of $7.1 billion in February.

CFO Talks

SEPTEMBER 10, 2024

Prioritize the alignment between financial projections and operational realities, ensuring that future growth assumptions are grounded in realistic business drivers. Valuation: Getting the Numbers Right Valuing a company isn’t just a numbers game; it’s about understanding the strategic fit of the target company within your organization.

PYMNTS

JUNE 19, 2020

More help for certain small business owners could be on the way if Congress approves the Prioritized Paycheck Protection Program (P4) Act, which would allow businesses with fewer than 100 employees to get a second loan. DoorDash Raising $400M On $16B Valuation. Plus, DoorDash is raising $400 million, valuing the company at $16 billion.

PYMNTS

NOVEMBER 13, 2019

The company, which was founded in 2013, has so far been unprofitable, but it has a valuation of $12.6 However, SoftBank has recently had some high-profile misses, like Uber and WeWork, who prioritized growth over being profitable. Rowe Price Group, which is investing in DoorDash for the first time as part of the same funding round.

PYMNTS

MAY 16, 2019

trillion valuation , as corporate buyers begin to demand the same online purchase experience in their professional lives that they have in their personal lives. The B2B eCommerce landscape is nearing a $1.8

PYMNTS

FEBRUARY 22, 2017

More importantly, the program will enhance the ability of our drivers to prioritize safety and deliver cost savings to the business.” billion valuation in 2021, researchers at MarketsandMarkets said, thanks to increased maintenance costs and fuel consumption, among other factors. percent CAGR through 2021.

PYMNTS

MARCH 7, 2018

That means easier communication with carriers, the report found, with industry professionals also prioritizing access to data regarding in-transit shipments, as well as “bidirectional communication” with partners on the supply chain. percent CAGR through 2021, hitting a valuation of more than $8 billion by the end of the period.

PYMNTS

JUNE 10, 2020

With Vroom motoring its way to a high-valuation IPO , it’s a good time to take stock of how a digital model for buying cars survived and thrived in the most challenging business environment of the digital era. The digital model was in a lot of ways made for what we’re dealing with right now,” says Shift CEO Toby Russell.

Global Finance

JUNE 9, 2025

BTG Pactual also retains the option to invest an additional R$1 million in the startups’ next funding round, with a 25% discount on the round’s valuation. As part of this work, the lab proposes, prioritizes, and builds new solutions to address core customer problems.

CFO Share

MARCH 27, 2024

Businesses that generate strong, steady ROIC often drive higher valuations than those with volatile or low ROIC. ROI enables you to: Avoid wasting capital on poor investments Compare several different initiatives and prioritize the best one Measure success of specific projects versus expectations Plan cash flow more effectively.

Future CFO

APRIL 14, 2020

Once some normality has returned, executives say that they will focus on prioritizing changes in new investments in digital and technology (43%) and capital allocation across their portfolio (42%), survey results indicate. The majority (72%) are also planning to conduct more regular strategy and portfolio reviews, the firm added.

Centage

SEPTEMBER 5, 2023

With more shoppers prioritizing necessities, businesses increasingly have to make adjustments to stay in the black. Four: Understand Customer Valuation Your customers are the source of your revenue – and your profits. A low valuation customer who typically purchases high margin items later on is a good investment.

PYMNTS

JANUARY 10, 2017

In early December, Symend closed a $1 million seed investment round, bringing Symend’s launch valuation to $2.5 Joshaghani said that Symend’s system allows participating companies to choose and prioritize which collection tactics and product features they want to use. million, said Joshaghani.

Future CFO

MARCH 13, 2024

Among CFOs who reported being approached the most, recruitment outreach is especially strong for female CFOs – women reported being reached out to more often (17%) when compared to men (12%), a sign that organizations are continuing to prioritize gender diversity within the C-Suite.

The Finance Weekly

JUNE 7, 2022

Facebook initiated the trend of rapid development and breaking things down and building back up; disruptive companies aspiring to unicorn valuations can also improve their efficiency. Design Gaps. Even companies that perhaps lack uniqueness are less attentive to the security aspects of applications and new products than is wise.

The Finance Weekly

MARCH 5, 2024

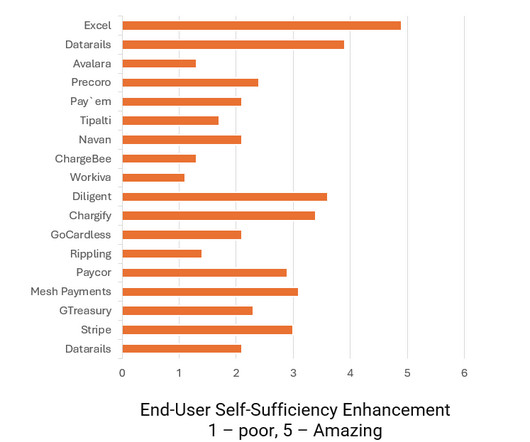

As anticipated, smaller companies with up to 150 employees tend to prioritize productivity. P,roductivity The last few years have seen significant advancements in productivity solutions, such as ,, Monday and ,, ControlUP , whose stock valuations have soared. It appears these advancements have not overlooked the finance department.

Barry Ritholtz

SEPTEMBER 3, 2024

But there’s always gotta be some element of the valuation really being compelling. But even in the book I wrote in 2014, you could see that the focus on competitive advantage can never be absolute, you always have to take valuation into consideration. But maybe second to valuation as a primary consideration.

E78 Partners

APRIL 13, 2023

This trend was made possible by the staggering amounts of capital available in private markets during an era of lower interest rates and surging valuations. Apple went public by its 5th birthday, but companies with similar profiles today stay private for an average of 12 years, and in some cases, up to 20 years.

CFO Talks

OCTOBER 1, 2024

Valuation and Reporting: Properly recognizing and valuing intangible assets impacts financial statements, investor relations, and the company’s market valuation. As a community of practitioners, we need to develop frameworks that enable us to properly prioritize investments and leverage technology more effectively.

BlueLight

AUGUST 21, 2020

From there I was recruited by Coopers & Lybrand in San Francisco to join their valuation group?—?before Staggering cost cuts is an approach that allows you to prioritize what and when you will cut based on different scenarios playing out. before they became PricewaterhouseCoopers.

PYMNTS

JUNE 16, 2018

Millennial dads are more likely than older dads to be grocery shoppers — 80 percent of millennial dads claim primary or shared grocery shopping responsibility, compared to 45 percent of all dads, according to Y&R’s BrandAsset Valuator (BAV) data. Dads are different from moms at the store, however.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content