How CFOs can structure an ESG-friendly tax strategy

CFO Dive

MARCH 3, 2022

ESG's tax implications is “a topic where there’s a two-way street,” said Kevin M. Jacobs, a managing director at Alvarez & Marsal Taxand.

This site uses cookies to improve your experience. By viewing our content, you are accepting the use of cookies. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country we will assume you are from the United States. View our privacy policy and terms of use.

topic tax

topic tax

CFO Dive

MARCH 3, 2022

ESG's tax implications is “a topic where there’s a two-way street,” said Kevin M. Jacobs, a managing director at Alvarez & Marsal Taxand.

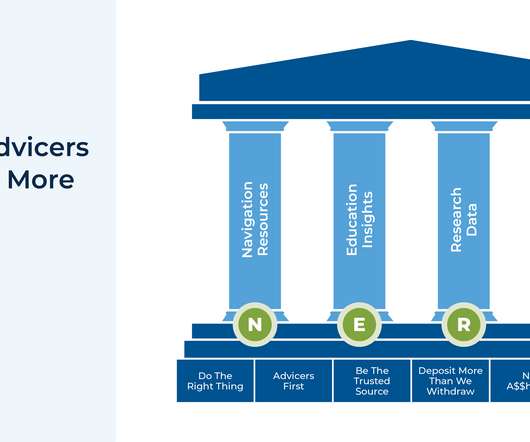

Nerd's Eye View

MAY 8, 2023

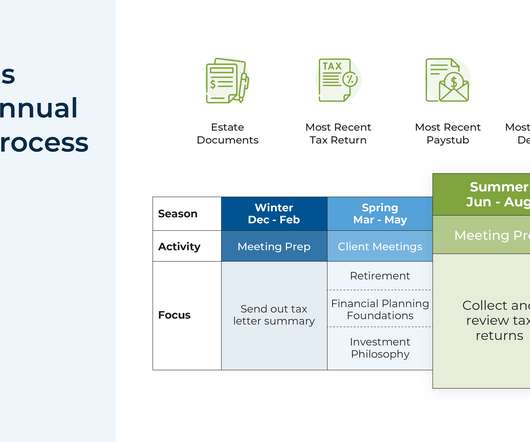

Traditionally, financial advice and tax preparation have existed as 2 related, but separate, services. CPA, EA, or JD) to prepare tax returns and represent clients before the IRS, there has also been the impression that there is simply not enough time for one person to do both.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

CFO News Room

DECEMBER 28, 2022

I’m a big fan of the Roth IRA and investors that understand it’s massive tax-free benefits are also. A Roth IRA is a type of individual retirement account (IRA) that allows you to contribute after-tax money and withdraw it tax-free in retirement. Roth IRA Conversion Taxes. What is a Roth IRA? Early Withdrawal Penalties.

CFO News

JUNE 12, 2023

This includes the establishment of Goods and Services Tax Appellate Tribunals, which is expected to streamline and expedite indirect tax litigations. The taxability of winnings from casinos, online gaming, and horse racing is another topic up for discussion.

Nerd's Eye View

NOVEMBER 21, 2022

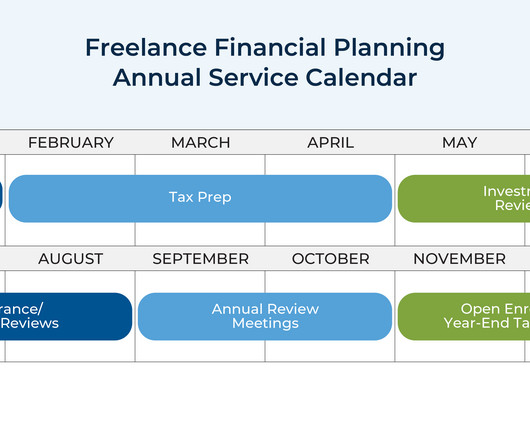

A common service model for many financial advisory firms is to schedule annual client meetings throughout the year where the advisor meets with each client in the month they started working with the firm, and conducts a comprehensive review of all planning topics for the client.

Adam Kae

JANUARY 5, 2024

The last 20 minutes of the hour we discuss a topic as a group. This includes the online community group where you can get your financial questions answered on-the-fly,and also our monthly virtual meeting where we go in-depth on the topics of your choice. We meet online 1 hour per month (the 1st Wednesday of the month at 1 ET).

Future CFO

FEBRUARY 6, 2024

He reiterated that ESG reporting remains an important topic and challenge for all. Another topic that will be important in 2024 is Pillar Two tax reform. Click on the PodChat player to hear Mo describe in detail the importance and evolving role of the CFO in Asia in 2024 and beyond.

Nerd's Eye View

DECEMBER 25, 2023

Each week in Weekend Reading For Financial Planners, we seek to bring you synopses and commentaries on 12 articles covering news for financial advisors including topics covering technical planning, practice management, advisor marketing, career development, and more.

Barry Ritholtz

OCTOBER 20, 2023

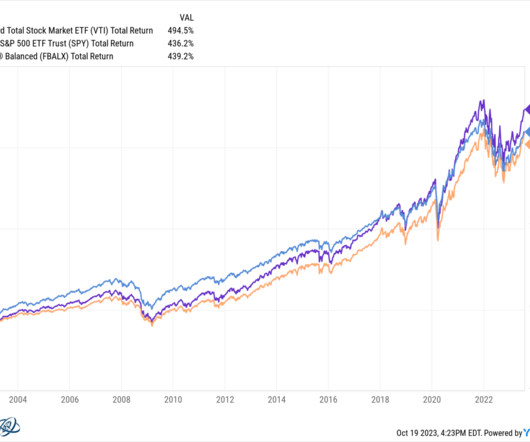

“I need the US Dollar to be a store of value between the time I make it until I spend it, invest it, pay my taxes with it, or give it away. To be more precise, I want to discuss the type of chart that reflects a fundamental misunderstanding of the nature of money, currency, spending, investing, and taxes. and paying taxes.

The Charity CFO

AUGUST 18, 2022

While most donors believe in your cause, the tax benefit is a significant motivator when raising money. But while your 501(c)(3) application is pending, your organization is not yet officially a tax-exempt entity. And if your application is denied for any reason, it could stick your trailblazing donors with a big tax bill.

Barry Ritholtz

NOVEMBER 20, 2023

His book What Investors Really Want delves deeply into that topic. Previously : Tax Alpha (April 14, 2022) Accessing Losses via Direct Indexing (April 14, 2021) The Cutting Edge (September 30, 2021) USA Is Smashing Its Clean Energy Targets (October 17, 2017) Sources : Wall Street’s ESG Craze Is Fading By Shane Shifflett WSJ, Nov.

Generation CFO

DECEMBER 20, 2021

We may have finessed this with rough bonus, employer tax and pension calculations and changes in FTE numbers, but that was as far as we went. HR analytics is now a hot topic, with KPIs and metrics going far beyond purely numerical data. To hear more on these topics, access the full webinar by clicking below. Access Full Webinar.

Adam Kae

MARCH 23, 2023

Answers with Adam: Question: Is there something I can do in the meantime to avoid making mistakes while I'm figuring out the best way to handle my business's sales tax? CFO Adam: Sales tax is the bane of every business owner that has to deal with sales tax. It's the bane of their existence. And for most accountants it is too.

The Charity CFO

DECEMBER 21, 2021

Many nonprofit founders think that they won’t have to worry about taxes. “Tax-exempt “ doesn’t mean that you don’t have to pay any taxes. It simply means that you don’t have to pay most federal and state income taxes. Do nonprofits pay income tax? Unfortunately, it’s just not true.

CFO News Room

DECEMBER 12, 2022

Inequality is a hot political topic. It depresses mobility through the impact of higher taxes that discourage investments (notably investments in human capital). It can increase mobility if taxes are used to finance educational programs that disproportionately benefit those at the bottom of the income ladder.

Future CFO

MARCH 11, 2021

“In this world, nothing can be said to be certain, except death and taxes” and the burden of calculating, reporting and complying with these taxes falls to the Office of the CFO. These tax departments face challenges with compliance, governance and infrastructure, caused by complex tax codes, siloed data and manual processes.

CFO News Room

JANUARY 17, 2023

It offers a way for employees to save for retirement on a tax-deferred basis, while also requiring employers to make contributions on behalf of their employees. Another key benefit of a Simple IRA is that it allows employees to make contributions to the plan on a pre-tax basis. Benefits of the Simple IRA vs 401k. Do not overlook this.

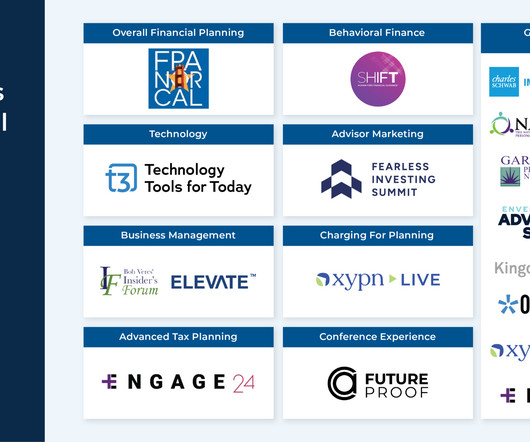

Nerd's Eye View

APRIL 7, 2023

Enjoy the current installment of "Weekend Reading For Financial Planners" - this week's edition kicks off with the news that the T3/Inside Information Software Survey is available, providing insights into which technology tools advisors use and their level of satisfaction with them, which highlighted the continued rise of specialized financial planning (..)

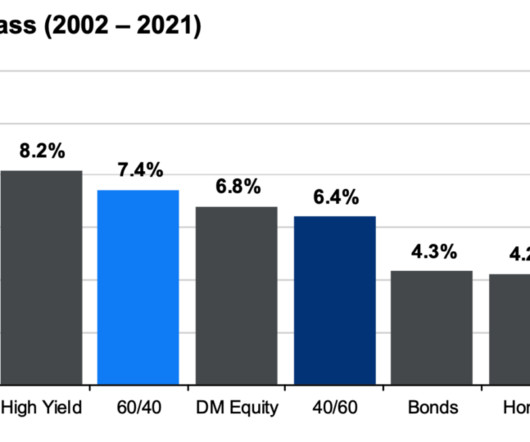

Barry Ritholtz

AUGUST 30, 2023

” on the topic; it snuck by during the dog days of summer. Whatever phrase you select, the persistent gap between investors’ performance and the assets they hold is a substantial drag on returns. I mention this in case you missed this Morningstar report “ Mind the Gap: A report on investor returns in the U.S.

Nerd's Eye View

SEPTEMBER 6, 2023

While asset protection is a popular planning topic for High-Net-Worth (HNW) and ultra-high-net-worth clients, those who are not HNW are susceptible to the same threats to wealth. Financial advisory clients are routinely concerned about lurking threats to their hard-earned wealth in the form of a large unforeseen judgment on a liability claim.

CFO News Room

DECEMBER 29, 2022

From there, you’ll pay a 0.25% annual investing fee to access multiple portfolio options, advanced tax-savings tools, automatic portfolio rebalancing, and other perks. . While not always the case, some states even offer tax breaks for contributing to a 529 plan. Retirement Topics – IRA Contribution Limits. Open a Roth IRA.

The Charity CFO

APRIL 13, 2023

If you’d like to dive deeper into any of the topics, we’ve included relevant links to further your knowledge. Taxes Yes, taxes. Understanding what tax and reporting requirements your organization may have is critical to maintaining that tax exempt status. Compliance requirements vary by state and funding sources.

Nerd's Eye View

OCTOBER 30, 2023

In addition, we've also updated our popular " Master Conference List " of all financial advisor conferences in 2024, both for advisors looking for a wider range of events to attend (if you want to delve deeper into a particular topical area), and for vendors looking for more conferences to exhibit at!

PYMNTS

FEBRUARY 23, 2020

G20 officials want to optimize taxes from tech giants like Google in a bid to help raise revenues in countries around the world, they said Sunday. New rules by the OECD outline the steps to do this, saying it could boost tax revenues by $100 billion a year. The G20 comments were mostly focused on the U.S.,

Onplan

DECEMBER 28, 2021

Third, looking at taxes and benefits expense we see a similar steady increase mirroring headcount growth. Unemployment tax rates vary by state, of course, and we’ll have more to say on that below. Taxes and benefits. Arkansas’ SUTA tax rate is almost double New York’s and almost triple Florida’s!

PYMNTS

OCTOBER 1, 2020

Consumers and microbusinesses now get an average of two disbursements each year, excluding tax disbursements from local, state and federal governments. 1: Instant disbursements as a percentage of all non-tax disbursements in the U.S. The study surveyed more than 5,000 U.S. Fast Fact No. are growing — but slowly.

PYMNTS

MARCH 12, 2019

Treasury official said a French tax plan targeting American digital companies is discriminatory against American businesses. Treasury’s top international tax official, called the taxes “ill-conceived,” and said the better option was to go after tax reform internationally at the Organisation for Economic Co-operation and Development ( OECD ).

PYMNTS

JUNE 9, 2019

Reuters noted that looking at the pros and cons of financial innovation is one of the many topics that will be discussed among the Group of 20 finance ministers. The meeting also resulted in the Group of 20 finance ministers announcing they will work together to create common rules to close corporate tax loopholes.

CFO News Room

DECEMBER 12, 2022

Here at Kitces.com, we have sought to provide advisors with the insights and education they need to help their clients (and their firms) navigate these uncertain conditions, from blog posts and podcasts on these trending topics to the continued expansion of our Kitces Courses and our popular monthly Office Hours and webinars.

The Charity CFO

MAY 10, 2022

So if your annual reporting period follows the calendar year, you’ll be required to be compliant when you file your IRS 990 for the 2022 tax year. A description of the valuation techniques and inputs you used to determine the fair market value of the gifts (in accordance with Topic 820 ). .

CFO News Room

JANUARY 6, 2023

This retirement account lets you invest with after-tax dollars, meaning you don’t get a tax benefit upfront. However, your money grows tax-free, and you won’t have to pay income taxes when you withdraw the money after retirement. Building relationships by investing in other people. Hire a Robo-Advisor.

PYMNTS

JANUARY 24, 2020

As previously reported, the range of topics under discussion at the World Economic Forum in Davos this week have been diverse , ranging from trade accords to climate change as well as Big Tech and digital taxes. Sovereign debt and high-tech initiatives, with the inclusion of artificial intelligence (AI), have been more recent topics.

CFO Simplified

AUGUST 7, 2023

This starts with discussing exit planning every 90 days to evaluate and agree upon current exit planning topics including timing, valuation requirements, exit options, opportunities to increase company valuation, and an exit or hold decision.

PYMNTS

JANUARY 22, 2020

The range of topics under discussion at the World Economic Forum in Davos this week has been — and will continue to be — diverse. Big Tech, too, of course, and digital taxes. And Digital Taxes. With a nod to digital taxes and trade disputes, the U.S. have been considering or embracing digital taxes. Climate change.

Future CFO

AUGUST 1, 2023

FutureCFO spoke to Deka to dig deeper into the topic: Which features/capabilities in financial applications are most in demand by mid-size enterprises? Streamlining payroll management, such as tax filing, salary payments, and benefits, is critical for mid-sized enterprises.

Barry Ritholtz

NOVEMBER 21, 2022

However you may describe Inflation, it sucks: A loss of buying power, a tax on consumers, a decrease in the value of savings, and a drag on GDP. It is a timely reminder about easy it is to be wrong about broad topics or fool ourselves via motivated reasoning. These are all annoyances of greater or lesser proportion to various people.

The Charity CFO

APRIL 8, 2022

However, filling out the application is an essential step in setting up a nonprofit charity with the full benefits of tax-exempt status. A 501c(3) application is a document nonprofit organizations file with the Internal Revenue Service (IRS) to request tax-exempt status as a charitable organization.

CFO News Room

NOVEMBER 23, 2022

22, the average margin on earnings before interest and taxes declined to 10.7% Below is a roundup of retail CFOs’ remarks on this topic during recent earnings calls. Profit margins in the sector have shrunk in recent months due to a mix of high inflation, excess inventory and growing expectations from consumers for price reductions.

Future CFO

SEPTEMBER 7, 2022

Sustainability, as a topic and a trend, covers more than finance. Audit professionals in tax must understand and apply carbon tax regulations and guidelines, to ensure compliance in diverse regulatory environments, both regionally and globally, ISCA added.

PYMNTS

JULY 16, 2019

France’s financial regulator is set to approve a wave of cryptocurrency-related firms in the country, subjecting them to new rules that include paying taxes and complying with capital requirements and consumer protections, according to a report by Reuters. France is a precursor.

Future CFO

NOVEMBER 2, 2020

China’s financial environment is the region’s most complex, followed by Vietnam, South Korea, Malaysia and Indonesia, according to TMF Group’s report titled Accounting & tax: The global and local complexities holding multinationals to account.

Barry Ritholtz

DECEMBER 7, 2023

Each week, we are going to spend 10 minutes diving into a specific topic that affects you and your money: Acquiring it, spending it, and most of all, investing it.

CFO Talks

JUNE 30, 2022

CPD for Finance Leaders: Extensive topics that cover the entire range of the CFO function, presented by experts. Access to Tax Knowledge Base. Commit to 30 hours of CPD per annum on topics of your choice. Executive Education. Officially registered certification for finance executives in South Africa.

Onplan

DECEMBER 28, 2021

Third, looking at taxes and benefits expense we see a similar steady increase mirroring headcount growth. Unemployment tax rates vary by state, of course, and we’ll have more to say on that below. Taxes and benefits. Arkansas’ SUTA tax rate is almost double New York’s and almost triple Florida’s!

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content