MiB: Aswath Damodaran: Valuations, Narratives & Academia

Barry Ritholtz

APRIL 8, 2023

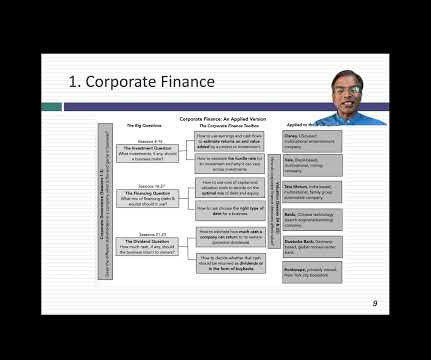

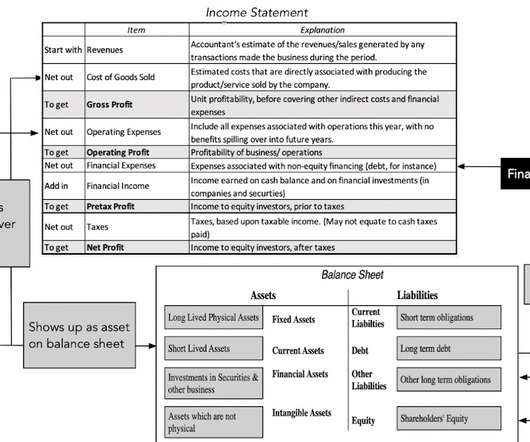

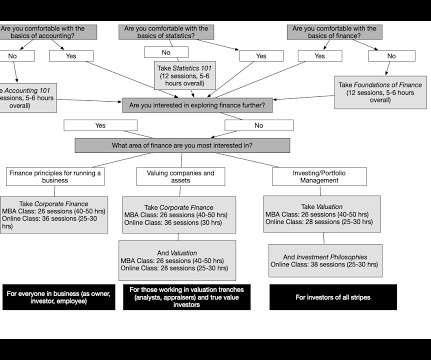

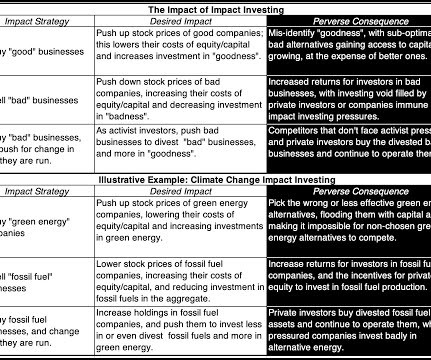

A nine-time “Professor of the Year” winner at NYU, Damodaran teaches classes in corporate finance and valuation to MBA students. He has also written several books on corporate finance and equity valuation and has published widely in journals. Damdoran loves “untangling the puzzles of corporate finance and valuation.”

Let's personalize your content