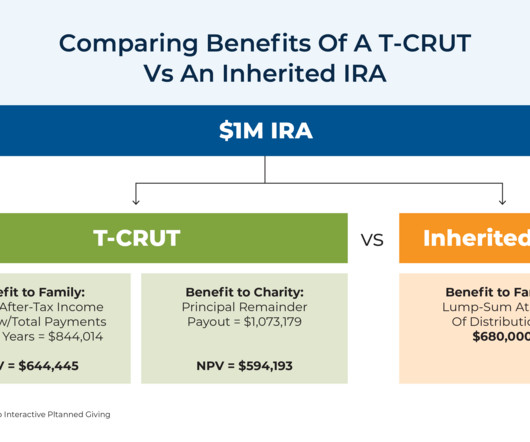

Using A Testamentary Charitable Remainder Unitrust (T-CRUT) To Give Twice To Both Loved Ones And Charitable Organizations

Nerd's Eye View

JANUARY 31, 2024

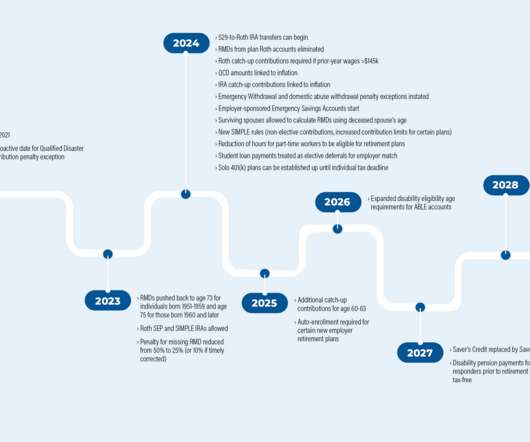

Under the new law, non-spouse beneficiaries (with few exceptions) must now withdraw the entirety of an inherited IRA within 10 years of the account owner's passing rather than over their own lifetimes. This shift has led financial advisors to explore new strategies for mitigating the resulting tax-planning challenges.

Let's personalize your content