Concentration Risk on the Buy-Side of Credit Markets: The Causes

CFA Institute

AUGUST 30, 2021

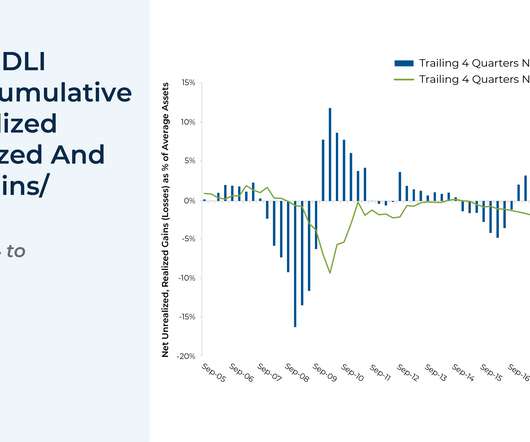

What are the effects of buy-side concentration on the structure of the corporate bond market?

This site uses cookies to improve your experience. By viewing our content, you are accepting the use of cookies. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country we will assume you are from the United States. View our privacy policy and terms of use.

CFA Institute

AUGUST 30, 2021

What are the effects of buy-side concentration on the structure of the corporate bond market?

CFO News Room

FEBRUARY 4, 2022

The share-price decline would wipe more than $175 billion from the tech giant’s market capitalization once markets open Thursday and could spell its worst daily performance since it started trading in 2012, according to FactSet. January’s market turmoil hit even the safest bond funds. Chart of the Day. Source link.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Musings on Markets

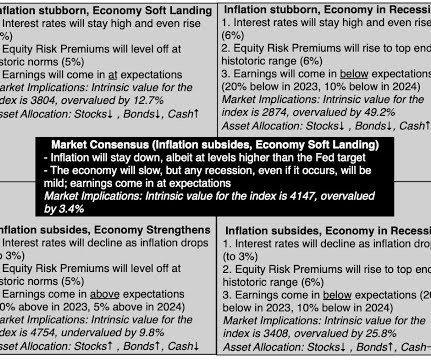

OCTOBER 4, 2023

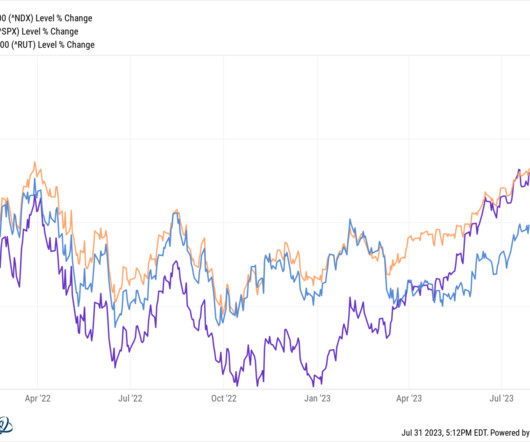

That recovery notwithstanding, uncertainties about inflation and the economy remained unresolved, and those uncertainties became part of the market story in the third quarter of 2023. The Markets in the Third Quarter Coming off a year of rising rates in 2022, interest rates have continued to command center stage in 2023.

Future CFO

OCTOBER 2, 2023

Moreover, current market conditions drive private fund managers to hone in on their cash management practices , with many turning to strategies more commonly used by their corporate counterparts. Money market funds are “particularly attractive” as they generate yield on idle cash and are highly liquid, according to Quinn.

Future CFO

AUGUST 3, 2023

Global VC investment dropped for the sixth consecutive quarter in Q2’2023 – falling from US$86.2 In Asia, VC investment fell for the 6th consecutive quarter, reaching only $20.1 The Americas accounted for the largest share of VC investment with $42.9 The Americas accounted for the largest share of VC investment with $42.9

PYMNTS

DECEMBER 16, 2020

Because of the lack of competition, the federal Commission on Economic Competition said the processing fees have gotten too high and incentives have been lowered for investing in new systems that could be safer for handling transactions and avoiding breakdowns.

CFO News Room

JANUARY 18, 2023

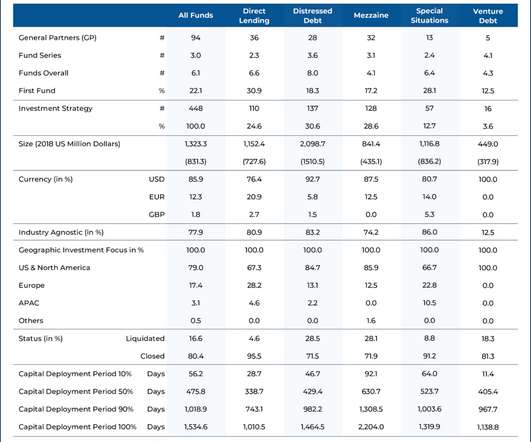

Many investors are familiar with private equity as an alternative asset class, which is popular with certain high-net-worth and institutional investors as a vehicle for diversification and a source of potentially higher risk-adjusted returns than what is available on the public market.

CFO News Room

JANUARY 31, 2023

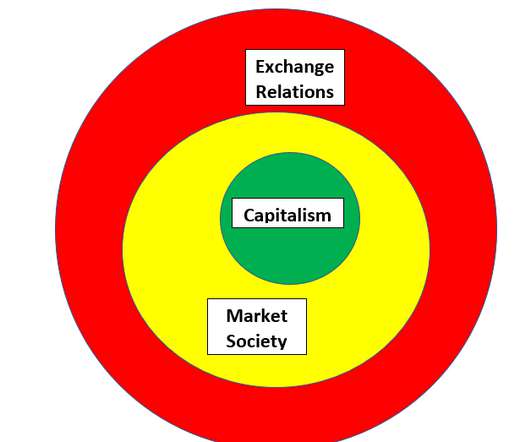

I have come to think of it in terms of concentric circles, each smaller than, and fully contained in, the larger category. For me, the categories are exchange relations, market societies, and capitalism. All capitalist countries are market societies, and use exchange relations. But many market societies are not capitalist.

Nerd's Eye View

FEBRUARY 23, 2024

Which suggests that instead of trying to go head-to-head with these larger firms (and their heftier marketing budgets) in attracting clients, smaller firms might instead demonstrate how they are 'different' by offering a unique service offering tailored to their ideal target clients.

CFO News Room

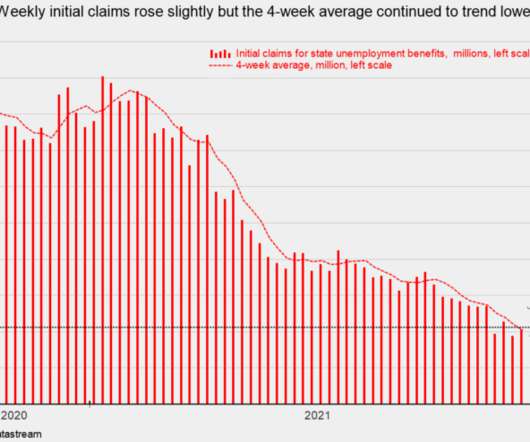

DECEMBER 16, 2021

The results suggest the labor market remains extremely tight. The gain was concentrated in the Pandemic Unemployment Assistance program and the Pandemic Emergency UC program, which accounted for 93,338 of the 107,674. The low level of claims and high number of open jobs suggest the labor market remains very tight.

CFO News Room

FEBRUARY 2, 2022

In the short-term, Bitcoin trades as a risky asset in an increasingly risk-on, risk-off market. We specifically mentioned three cryptocurrencies in this article, but there are actually more than 10,000 coins in the crypto world, so it’s important to categorize the coins before making investment decisions.

Barry Ritholtz

DECEMBER 30, 2023

When she returned to Franklin Templeton, she rotated through various divisions, including investment management, distribution, technology, operations, and high-net-worth. There’s not enough discussion about how the market risk of the index changes depending on [a few stocks].

CFO News

JUNE 6, 2023

The Securities and Exchange Board of India (SEBI) has proposed a new rule to track the source of foreign money for high-risk investors in an effort to root out questionable foreign investment in India’s publicly traded companies. If passed, the new rule would require any investor with more than INR 250 billion ($3.3

Barry Ritholtz

JULY 8, 2023

When she returned to Franklin Templeton, she rotated through various divisions, including investment management, distribution, technology, operations, and high-net-worth. There’s not enough discussion about how the market risk of the index changes depending on [a few stocks].

Barry Ritholtz

AUGUST 1, 2023

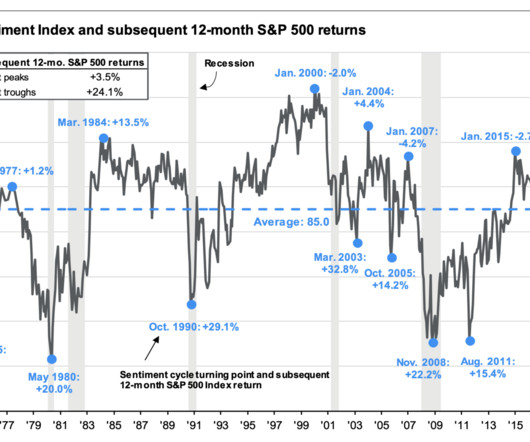

After a monstrous 68% recovery from the March 2020 pandemic low, and another nearly 30% gain in 2021, markets decided to have one of their all-too-regular spasms. The wisdom of the crowd is why the efficient markets work most of the time, but it really helps to be aware when the crowd turns into an unthinking mob of hooligans.

Barry Ritholtz

JANUARY 24, 2024

Full transcript below. ~~~ About this week’s guest: Ari Rosenbaum serves as the Director of Private Wealth Solutions at O’Shaughnessy Asset Management , now part of investing giant Franklin Templeton. Ari Rosenbaum : The challenge with that is that markets go up more often than they go down. Equity returns. Barry Ritholtz : Okay.

Future CFO

APRIL 22, 2024

The evolution of the finance function over the past few years has been anything but apparent, with the whole advent of digitalisation within the team and the non-stop shifts in the market. The right mix between remote [and] in-person office work is a constant investment,” Cheah says.

PYMNTS

MARCH 31, 2020

Now we’re going to take a smaller storefront and concentrate more online. Over the years, we’ve developed procedures to establish provenance (chain of ownership) to ensure that our pieces are both authentic and on the market in accordance with international law.” The three major art and antiques markets – the U.S.,

PYMNTS

MAY 14, 2018

Taking a page from Goldman Sachs’ book, Morgan Stanley is beginning to lend to FinTech startups in Brazil as it seeks more of a return on its investments. Morgan Stanley’s move comes at a time when the Brazil FinTech market is exploding. Fortress Investment Group also took part in that deal.

Future CFO

JULY 17, 2023

Faced with ongoing market volatility, the enterprise C-suite is leaning on its treasury teams like never before to protect company assets and to (ideally) also capitalise on competitive opportunities emerging from an unstable macroeconomic climate. This article discusses some of the key takeaways from that report.

Barry Ritholtz

NOVEMBER 27, 2023

My back-to-work morning reads: • How to Tweak Your Investments for a More Normal Market : Convert a traditional IRA to a Roth IRA; Higher interest rates means cash gets a respectable yield; Revisit concentrated positions; consider adding international stocks; buy longer-dated Treasuries.

Future CFO

JANUARY 23, 2024

Strong fundamentals in the ASEAN region itself are also driving increased investment and trade activity. India is benefiting from a low cost structure, increasingly capable workforce, and improving logistics to rise as a major domestic market and “China + 1” destination for global manufacturing. China Trade Dynamics. India ignition.

Musings on Markets

JANUARY 28, 2024

In my last data updates for this year, I looked first at how equity markets rebounded in 2023 , driven by a stronger-than-expected economy and inflation coming down, and then at how interest rates mirrored this rebound.

VCFO

JANUARY 23, 2024

In much the same way as, diversifying investments is a prudent strategy to mitigate personal risk, strategizing the sale of your business well in advance is an integral step toward securing your financial future. Implement strategic initiatives to improve profitability, streamline operations, and fortify your market position.

Barry Ritholtz

AUGUST 26, 2022

Say what you will about Cathy Woods and ARKK, but a concentrated portfolio like hers makes more sense as a satellite to Vanguard’s Total Stock Market Index ETF (VTI) or the S&P 500 (SPY) versus this unholy mess of high-cost high turnover SMA. First Rule of Running Other Peoples’ Money? Do No Harm (March 20, 2016).

Future CFO

DECEMBER 18, 2020

FutureCFO spoke to three executives for their expressed views on the impact of COVID-19 on the Asia Pacific’s (APAC) credit market: Mike San Diego, chief financial officer at JK Capital Finance; James Ponsford, regional director & growth leader, Credit Solutions, Asia at Aon; and Matthew Wells, APAC regional commercial director for Euler Hermes.

Nerd's Eye View

JANUARY 18, 2023

Many investors are familiar with private equity as an alternative asset class, which is popular with certain high-net-worth and institutional investors as a vehicle for diversification and a source of potentially higher risk-adjusted returns than what is available on the public market.

Future CFO

AUGUST 23, 2023

Mature consumers constitute a large and growing segment that is currently responsible for 27% of spending — around US$7 trillion — each year across nine product categories in 12 key markets, BCG pointed out. Nevertheless, brand marketeers often ignore them, the firm added. Nothing could be further from the truth.

VCFO

NOVEMBER 7, 2023

It entails a deep dive into many facets of operations including the status of contracts, customer concentration risk, the ability to deliver services, and other expense drivers. Market trends and regulatory changes are additional areas of focus. The QoE looks at the sustainability and accuracy of future profits.

CFO News Room

DECEMBER 28, 2022

Innovation and exchange can be frustratingly uninspiring, particularly given that there are concentrated, vivid costs (in the form of lost jobs and struggling communities) and benefits dispersed across millions of people who might not even notice. is sort of intuitive and superficially appealing.

Barry Ritholtz

OCTOBER 19, 2023

One of my favorite responsibilities as chief investment officer at Ritholtz Wealth Management is the quarterly conference call I do for our clients. I run through 30 charts in 30 minutes that explain where we are in the economic cycle, what markets are doing, and what it means to their portfolios.

Future CFO

DECEMBER 21, 2023

Can you go to the capital markets or turn to your line of credit to raise money if need be? Shorten your supply chains and avoid concentration in one geographic region. Operating margins: Are they becoming thinner? Debt maturities, refinancing , and ability to raise capital: Under what terms can you refinance your debt?

Spreadym

NOVEMBER 3, 2023

Saving and Investing: Develop a savings plan and investment strategy to build wealth over time. 401(k), IRA), investing in stocks, bonds, real estate, or other assets, and establishing an emergency fund. This metric reflects your ability to invest in growth or return value to shareholders. Liquidity Ratios: a.

CFO News Room

JANUARY 11, 2023

Sellers need to avoid a spread-the-peanut-butter approach and instead concentrate resources on the most promising opportunities. The emerging winners will be the ones who take a more nuanced approach, tailoring the answer to the strength of their own products and markets, as well as to how economic uncertainty affects their customers.

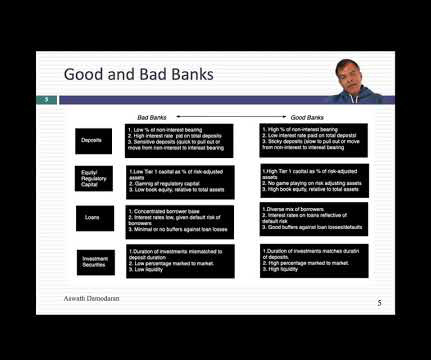

Musings on Markets

MAY 5, 2023

The overarching questions for us all are whether this crisis will spread to the rest of the economy and market, as it did in 2008, and how banking as a business, at least in the US, will be reshaped by this crisis, and while I am more a dabbler than an expert in banking, I am going to try answering those questions.

PYMNTS

MAY 19, 2020

The email states that the new outreach will look at digital brands, marketing, analytics and metrics, and making sure that the company is sufficiently invested in the new digital world. The new group will ensure that there is a cross-ICG strategy that encompasses the needs of corporates, investors and individuals, the email states.

CFO News Room

JANUARY 17, 2023

As the world’s attention is focused on the war in the Ukraine, it is the human toll, in death and injury, that should get our immediate attention, and you may find a focus on economics and markets to be callous. The Market Reaction. Bond Markets and Default Risk. Equity Markets and Equity Risk Premiums. The Lead In.

Barry Ritholtz

MAY 15, 2023

My back-to-work morning train WFH reads: • Ken Griffin’s Hand-Picked Math Prodigy Runs Market-Making Empire : Citadel Securities CEO Peng Zhao left for college at age 14, caught Griffin’s eye early in his career and built systems now mopping up market share. Bonds : Short-term costs for insuring U.S. Slate ) but see also Will A.I.

CFO News Room

JANUARY 8, 2023

By fall of 2022, NFT markets were down 90% , we’d entered a cold crypto winter, and a bustling metaverse was still more of a dream than reality. Leaders will have to search for ways to do more with less, find value where innovations overlap, and strategically invest in technologies that are hitting a tipping point.

PYMNTS

JANUARY 28, 2020

Index Ventures and Accel, two early investors in Deliveroo , are speaking out against the Competition and Markets Authority (CMA) in the U.K., Amazon plans to lead a funding round in the company with a $575 million investment. 28) by the Financial Times. . The investors are accusing the CMA of jeopardizing the deal.

PYMNTS

AUGUST 27, 2020

Walmart is selling two of its online brands in a continuing goal to concentrate on its website. Last fall, Walmart sold ModCloth , a vintage-inspired women’s clothing, shoes, handbags and accessories eTailer, to Go Global Retail , a Los Angeles investment platform that invests in fashion and retail, for an undisclosed amount.

Generation CFO

JANUARY 28, 2022

With the argument centring around that we can’t concentrate, we don’t knuckle down and stick something out through tougher times. . This transparency also helps build consensus-based scenario planning, where decisions can be explored and talked about before they’re enacted. It’s too easy for leaders to throw mud at millennials,” says James.

PYMNTS

JUNE 2, 2016

Singapore also has a heavily concentrated smartphone population. In fact, according to most estimates, Singapore has the highest smartphone per capita in the world with more than 100 percent smartphone market penetration. Singapore isn’t the only Asian market that Apple is eyeing. Android Pay Eyes Singapore Market.

PYMNTS

JANUARY 23, 2020

We are investing close to ?100 And global online giant Amazon recently invested $1 billion in India development to sell groceries and other items. We concentrate a lot of annual marketing around this event. The company expects a large return on investment for the 2020 event. 18 and will continue through Jan.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content