Vera Bradley gets new CFO amid leadership shakeup

CFO Dive

JUNE 12, 2025

Coach alum Martin Layding will step into the retailer’s CFO seat amid a transformation effort to stem growing losses and bolster declining sales.

CFO Dive

JUNE 12, 2025

Coach alum Martin Layding will step into the retailer’s CFO seat amid a transformation effort to stem growing losses and bolster declining sales.

CFO Talks

JUNE 12, 2025

From Red to Black: CFO Strategies That Drive Organisational Turnarounds When an organisation faces financial distress, the Chief Financial Officer becomes a pivotal figure in determining whether the business continues to decline or begins the path to recovery. Leading a company from financial loss to profitability requires far more than cost-cutting or boosting revenue.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

CFO Dive

JUNE 12, 2025

The decision to pick its new controller from its ranks aligns with the warehouse club retailer’s history of developing and keeping its financial bench talent.

CFA Institute

JUNE 12, 2025

Search funds stand out as a valuable alternative asset class, offering diversification, alpha potential, and operational upside in underserved markets.

Speaker: Joe Wroblewski, Sales Engineer Manager

Automating time-consuming manual tasks can save your firm hundreds of hours–and thousands of dollars. But it can also have longer-lasting benefits, like helping you attract and retain the next generation of CPAs, and we don’t need to tell you how important that is amid the current generational staffing crisis in the tax and accounting profession. You'll want to save your seat for this new webinar with industry expert Joe Wroblewski, where we'll explore how to: Maximize ROI with Cost-Effective Te

E78 Partners

JUNE 12, 2025

In today’s market, private equity firms recognize that acquisition alone no longer drives sufficient growth. As interest rates rise, deal pipelines tighten, and LPs apply more pressure, firms shift their focus from revenue expansion to margin improvement as the core value driver. In 2025, top-performing firms go beyond sourcing deals. They optimize them.

Corporate Finance Brief brings together the best content for corporate finance professionals from the widest variety of industry thought leaders.

Trade Credit & Liquidity Management

JUNE 12, 2025

From a Press Release dated June 9, 2025, Fort Lee, NJ Cross River Bank has launched its Request for Payment (RfP) solution, a new feature designed to enable secure, real-time inbound payments via the RTP® (Real-Time Payments) network. This innovation addresses a longstanding imbalance in money movement: while outbound payments have become nearly instantaneous, incoming payments have typically relied on slower methods like ACH and wire transfers, which are limited by batch processing and ban

Future CFO

JUNE 12, 2025

Digital transformation and innovation emerges as top deal drivers in Southeast Asia, making it a major motivator for M&A deals. According to Norton Rose Fulbright 's Global M&A trends and risks report, which is in collaboration with Mergermarket , the findings reflect the efforts to acquire new technologies and modernise businesses. In Southeast Asia, local private equity firms are particularly eager to deploy funds in mid-market deals.

Trade Credit & Liquidity Management

JUNE 12, 2025

From a Press Release dated June 10, 2025, San Francisco, CA Ratio , a platform that uniquely combines embedded Buy Now, Pay Later (BNPL) with a fully integrated Quote-to-Cash system for B2B subscription businesses, has reported over 800% growth in the past year and announced the launch of its new Custom Payment Terms feature. This innovation allows sellers to tailor financing options to each buyer’s cash flow requirements while still receiving full upfront revenue, effectively removing the

CFO Thought Leader

JUNE 12, 2025

During a high-pressure period at Visa following a restatement, Rene Ho shifted forecasting away from false precision. He required teams to present scenario ranges with clear reasoning, holding them accountable for understanding—not just outcomes. The result: deeper business insight and a forecasting culture grounded in strategic awareness, not guesswork.

Advertisement

Automation generally supercharges any process and brings its value to the forefront. See how infusing automation such as ART (our month-end close solution), into your close can get you to the next level of closing. We will share a live demo of SkyStem's solution, ART and share the key elements of month-end close automation. Through ART, we'll take a look at: What month-end close automation entails Which process steps can and should be automated Benefits of achieving process automation, and Why i

Trade Credit & Liquidity Management

JUNE 12, 2025

In an economic landscape marked by ongoing uncertainty, small businesses continue to navigate shifting consumer behaviors and market dynamics with remarkable adaptability. As the backbone of local economies, these enterprises are adjusting to evolving demands, balancing essential needs with discretionary spending, and finding new ways to engage customers.

CFO News

JUNE 12, 2025

There has been a surge in private investments in the last 11 years, with Indian startups and emerging entities attracting significant private funding to the tune of over $150 billion in the past decade, Commerce and Industry Minister Piyush Goyal said on Thursday.

Trade Credit & Liquidity Management

JUNE 12, 2025

Featured Articles Trade Credit & Liquidity Management is a reader-supported publication. To receive new posts and support our work, consider becoming a subscriber. For a limited time, annual subscriptions are half off Conversations “The culture you have in your organization is the sum of all the wanted behaviors that you celebrate, minus all the unwanted behaviors that you tolerate.” — Danny Meyer Action Items Do you like the newsletter?

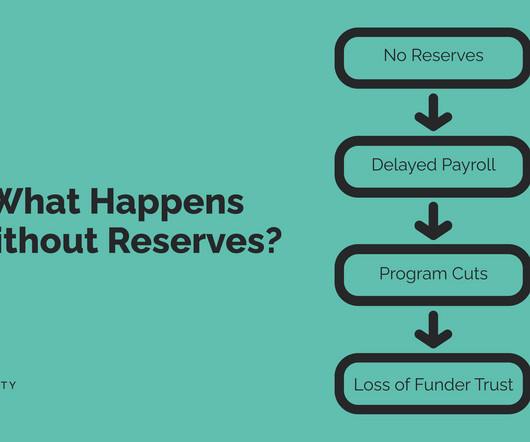

The Charity CFO

JUNE 12, 2025

No matter your size or mission, every nonprofit needs operating reserves. But how much is enough? And how do you convince your board it’s not just okay to use them—but essential? In this blog, we’ll unpack what operating reserves are (and what they’re not), how to determine the right amount for your organization, and how to manage them responsibly over time.

Advertiser: Paycor

Mid-year performance reviews aren’t just boxes for HR to check. Paycor’s toolkit empowers leaders to: Identify high-potential team members. Boost engagement with meaningful feedback. Support struggling employees. Nurture top talent to drive results. Learn how to ignite employee potential through meaningful feedback. When you nurture top talent, everybody wins.

CFO News

JUNE 12, 2025

The Finance Ministry’s denial of plans to reintroduce MDR on UPI payments has dampened fintech firms’ monetisation hopes, leading to a drop in their stock prices. Industry players had anticipated MDR's return for large transactions, which could boost revenues, especially ahead of several upcoming fintech IPOs.

CFO Dive

JUNE 12, 2025

Skip to main content CONTINUE TO SITE ➞ Dont miss tomorrows CFO industry news Let CFO Dives free newsletter keep you informed, straight from your inbox. Daily Dive M-F Tech Weekly Every Tuesday By signing up to receive our newsletter, you agree to our Terms of Use and Privacy Policy. You can unsubscribe at anytime. Deep Dive Opinion Library Events Press Releases Topics Subscribe Search Subscribe Search Strategy & Operations Financial Reporting Compliance Technology Treasury Risk Management L

CFO News

JUNE 12, 2025

Delivering the keynote address at ETCFO NextGen Summit 2025, Ananth Narayan said there are some perceived challenges around valuations including a perceived conflict of interest, “valuation shopping”, and wide divergence in valuations due to differing assumptions.

Global Finance

JUNE 12, 2025

The year-and-a-half-long saga of Nippon Steel Corp.’s bid to buy U.S. Steel took another twist late last month when President Trump unexpectedly announced via social media post a “blockbuster agreement” to finally conclude the deal. But if we’re now in the final act of the drama, that was just Scene 1. Scene 2 came and went on June 6, when Trump missed what was supposed to be a deadline to approve or reject a deal.

Speaker: Victor C. Barnes, CPA, MBA

In the climb from contributor to leader, the rules quietly change. If you’re aiming for the summit, the air gets thinner—and what got you here won’t be enough to get you to the top (a concept first popularized by Marshall Goldsmith in his book What Got You Here Won’t Get You There ). What made you successful early in your finance career—technical accuracy, sharp analysis, flawless execution—won’t be what carries you to the next level.

CFO News

JUNE 12, 2025

Stock Market Crash: Indian stock markets crashed early Friday following Israeli strikes on Iran. This mirrored losses in Asian markets. The BSE Sensex and Nifty50 both saw significant drops. The oil & Gas sector suffered the most. Broader market indices also declined. Market capitalisation decreased substantially. The Israeli strike and surging oil prices are key factors.

CFO News

JUNE 12, 2025

The Air India crash in Ahmedabad is expected to result in India's costliest aviation insurance claim, with estimates exceeding $120 million. The aircraft's hull loss alone is pegged at around $80 million, while passenger liability may range from $30–100 million due to high-net-worth passengers. Tata AIG is the lead insurer, with others like New India Assurance holding minor stakes.

CFO News

JUNE 12, 2025

Shares of One 97 Communications, the parent company of Paytm, fell by up to 10 per cent on Thursday, hitting a low of Rs 864.20 on the Bombay Stock Exchange (BSE).

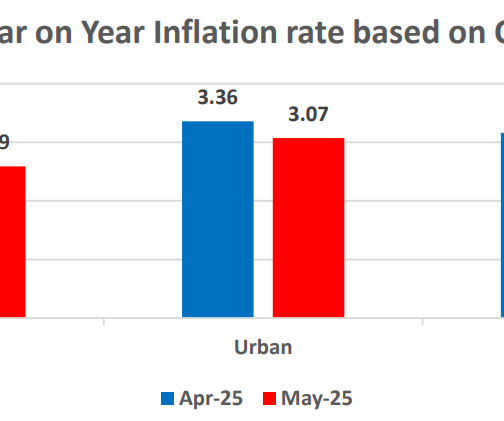

CFO News

JUNE 12, 2025

India’s retail inflation declined to 2.82% in May 2025, the lowest since February 2019, led by a sharp fall in food inflation to 0.99%. Both rural and urban regions saw a broad-based easing in price pressures, especially in key food categories. Despite the national moderation, states like Kerala, Punjab, and Jammu & Kashmir reported relatively higher inflation rates.

Speaker: Kim Beynon, CPA, CGMA, PMP

The most overlooked, yet most critical, element of transformation is preparing people for change. Automation and AI aren't just technical upgrades, they’re cultural shifts which can challenge identities. That’s why change management isn’t a side project—it’s the foundation. In finance, where precision and process rule, navigating change can feel especially disruptive.

CFO News

JUNE 12, 2025

Corporate capex by listed non-financial companies jumped 20% YoY to over Rs 11 lakh crore in FY25, exceeding the government’s spending and reflecting broad-based growth, per ICICI Securities. While Reliance Industries led in scale despite flat growth, capex in telecom and RIL remained muted, underscoring the diversified nature of corporate investments this fiscal.

CFO News

JUNE 12, 2025

Happiest Minds Technologies Limited has appointed Anand Balakrishnan as its new Chief Financial Officer, succeeding Venkatraman Narayanan, who is now the Managing Director. Balakrishnan brings over 20 years of experience from companies like Marsh McLennan, GE Healthcare, and Mindteck. He is expected to strengthen financial processes and governance, leveraging his expertise in financial management and business strategy.

CFO News

JUNE 12, 2025

Oil prices dramatically surged following Israel's strikes on Iranian military and nuclear sites, escalating fears of a broader conflict in the Middle East. West Texas Intermediate soared by 12.6 percent, while Brent crude jumped 12.2 percent.

CFO News

JUNE 12, 2025

India is open to mutually beneficial arrangements with trusted trading partners regarding quality standards implementation, according to Commerce and Industry Minister Piyush Goyal. India aims to promote the manufacturing of quality goods through Quality Control Orders (QCOs), ensuring equal treatment for both domestic and foreign suppliers.

Speaker: Mark Gilham, FCCA, CPP

Finance used to be the function that counted, now it's the one that’s counted on. 📊 For accounting firms, controllers, and finance leaders, expectations are rising faster than headcount. Businesses want agile forecasts, granular analysis, seamless reporting, and smart automation—often without added resources while demanding uncompromised accuracy and compliance.

Let's personalize your content