Valuation and Corporate Governance Consequences

CFO News Room

JANUARY 15, 2023

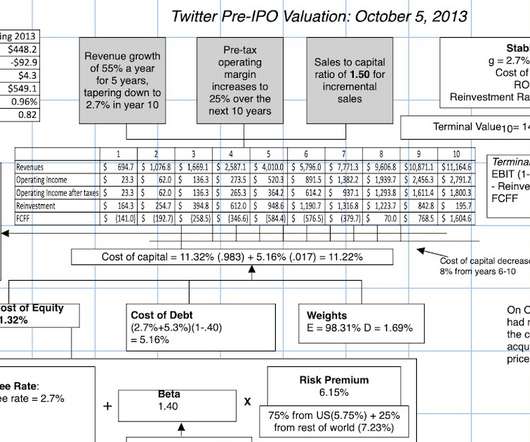

billion and predicted operating margin of 25% in that year reflected my optimistic take for the company, with substantial reinvestment (in acquisitions and technology) needed along the way (as seen in my reinvestment). Note that I am capitalizing R&D expenses to give the company healthier margins right now, to begin my valuation).

Let's personalize your content