Weekend Reading For Financial Planners (June 14–15)

Nerd's Eye View

JUNE 13, 2025

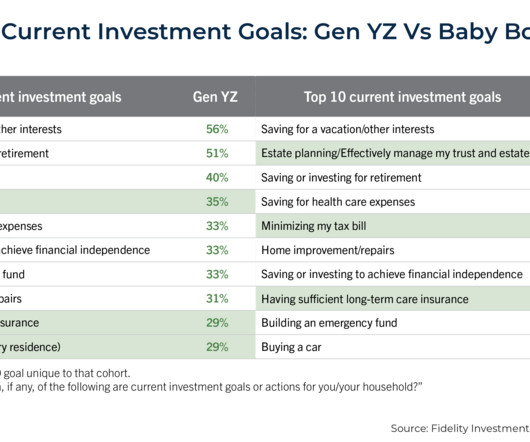

Other key findings from the survey included a gap between long-term investment return expectations of investors and advisors (12.6%

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Nerd's Eye View

JUNE 13, 2025

Other key findings from the survey included a gap between long-term investment return expectations of investors and advisors (12.6%

Nerd's Eye View

JUNE 18, 2025

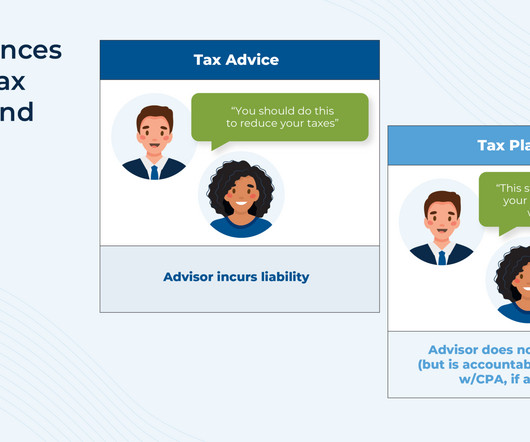

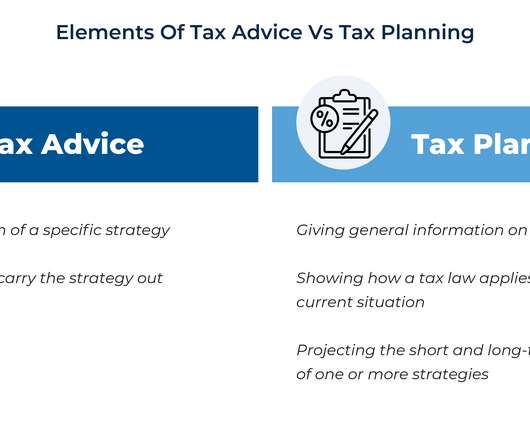

In recent years, financial advisors have increasingly embraced tax planning as a core element of delivering value to clients. Despite this growing interest in tax conversations, most advisors are still quick to distinguish their services as "tax planning", not "tax advice" – a distinction largely driven by liability concerns.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

How To Overcome Change Fatigue In Finance With Neuroscience-Backed Strategies

From Curiosity to Competitive Edge: How Mid-Market CEOs Are Using AI to Scale Smarter

Protect What Matters: Rethinking Finance Ops In A Digital World

Why Tech-Forward Tax and Accounting Firms Have the Inside Track to the Future

Your Accounting Expertise Will Only Get You So Far: What Really Matters

Nerd's Eye View

NOVEMBER 15, 2024

Also in industry news this week: NASAA has proposed an amendment to its broker-dealer conduct model rule that would restrict the use of the terms “advisor” and “adviser” for broker-dealers and their registered representatives who are not also investment advisers or investment adviser representatives A recent study suggests that (..)

How To Overcome Change Fatigue In Finance With Neuroscience-Backed Strategies

From Curiosity to Competitive Edge: How Mid-Market CEOs Are Using AI to Scale Smarter

Protect What Matters: Rethinking Finance Ops In A Digital World

Why Tech-Forward Tax and Accounting Firms Have the Inside Track to the Future

Your Accounting Expertise Will Only Get You So Far: What Really Matters

Nerd's Eye View

NOVEMBER 19, 2024

So, whether you're interested in learning about building a profitable hyperfocused practice, implementing a marketing approach that reaches a firm's ideal target client, or adding value for clients by offering advanced tax planning, then we hope you enjoy this episode of the Financial Advisor Success Podcast, with Anjali Jariwala.

Nerd's Eye View

NOVEMBER 30, 2022

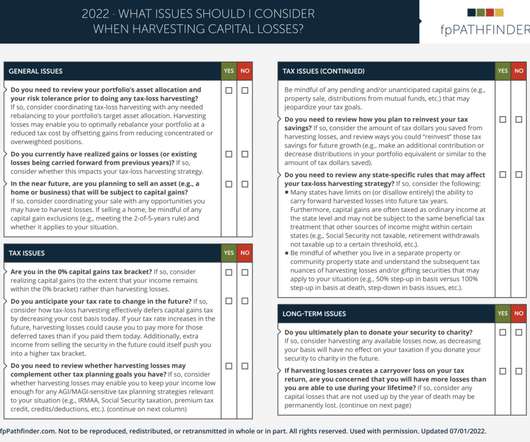

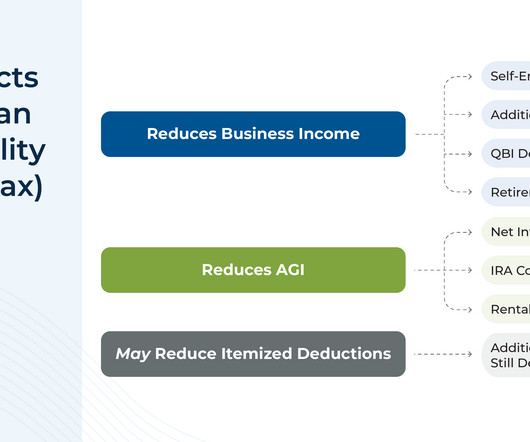

Taxes are a central component of financial planning. Almost every financial planning issue – whether it is retirement, investments, cash flow, insurance, or estate planning – has tax considerations, and advisors provide a great deal of value in helping clients minimize their overall tax burden.

Nerd's Eye View

JANUARY 21, 2025

What's unique about Daniel, though, is how his firm has expanded its tax focus to include "in-house" tax return preparation for its clients as a one-stop shop, but actually outsources the tax preparation work itself to trusted CPAs that he pays out of his own revenue (rather than bringing this service fully in-house) so that he can focus his staff (..)

Nerd's Eye View

MAY 16, 2025

Enjoy the current installment of "Weekend Reading For Financial Planners" - this week's edition kicks off with the news that Republicans in the House of Representatives this week released their long-awaited tax plan to address the impending sunset of many measures in the 2017 Tax Cuts and Jobs Act.

Nerd's Eye View

NOVEMBER 1, 2024

Enjoy the current installment of "Weekend Reading For Financial Planners" - this week's edition kicks off with the news that SIFMA, which represents broker-dealers, investment banks, and asset managers, released a white paper that argues that CFP Board "increasingly functions as a de facto private regulator for CFP certificants" and proposes that CFP (..)

CFO Plans

SEPTEMBER 24, 2024

Discover expert tax planning and accounting services designed to help you thrive. Effective tax planning and accounting are not just about compliance; they are about unlocking opportunities for growth and stability. In conclusion, effective tax planning and accounting are vital for the success of small businesses.

Nerd's Eye View

OCTOBER 28, 2024

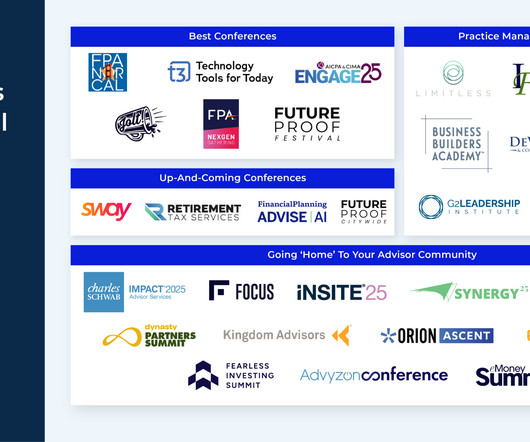

These discussions can range from talent development and succession planning to how to systematize and scale their marketing alongside their planning and investment services.

Nerd's Eye View

JUNE 12, 2025

Tax planning often fits the 'kind environment' model: The rules are relatively stable, outcomes repeat annually, and feedback is immediate (e.g., a tax bill or refund). Kind environments have clear rules, quick feedback, and consistent patterns, making them easier to navigate and learn from.

Nerd's Eye View

MAY 29, 2025

investment strategies or tax planning) – can reduce cognitive overload for clients and keep meetings on track. Visual aids can also help advisors clarify complexity and reinforce key messages. Summary charts or graphics – especially for topics that come up repeatedly (e.g.,

Global Finance

DECEMBER 6, 2024

Fifth Third has focused on improving customer satisfaction and retention without losing sight of their tried-and-true historical approach to wealth management, by promoting a problem-solving culture that encompasses human interactions, software improvements, and investment strategy building.

Nerd's Eye View

APRIL 7, 2025

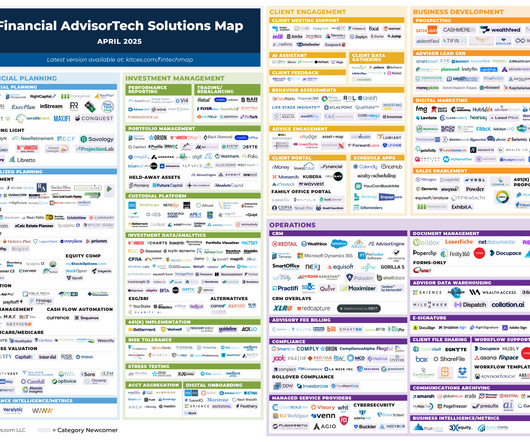

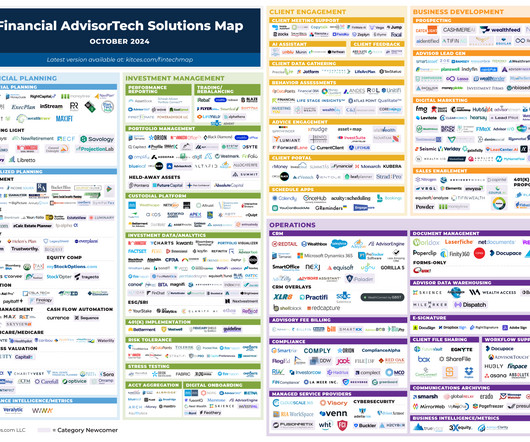

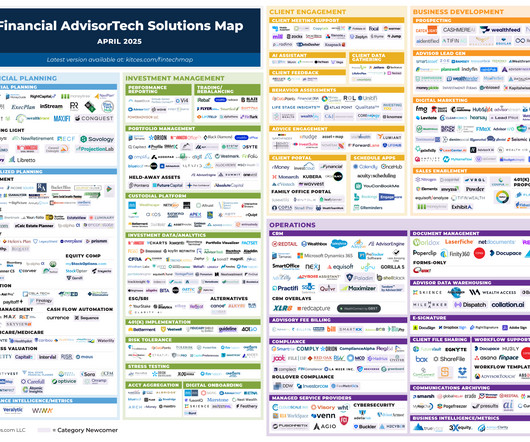

This month's edition kicks off with the news that Wealthbox has announced it is planning to launch a new built-in AI meeting note tool that it seeks to integrate seamlessly with its existing CRM solution – which serves as a prominent warning for the many standalone AI meeting note tools like Jump and Zocks that have launched over the last few (..)

Nerd's Eye View

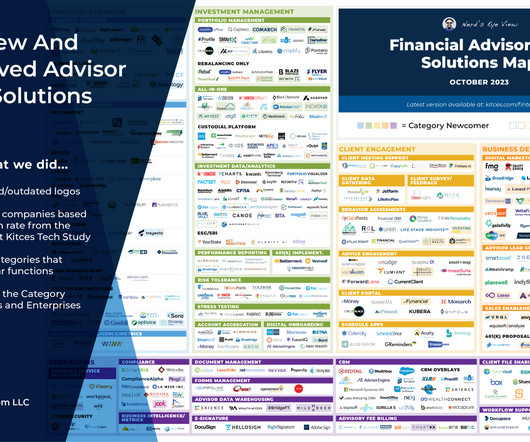

OCTOBER 27, 2023

Enjoy the current installment of "Weekend Reading For Financial Planners" - this week's edition kicks off with the news that the shift in financial advice from pure investment management to comprehensive financial planning continues, with more individuals becoming CFP professionals than CFAs in the past few years as consumers increasing the diversity (..)

Nerd's Eye View

FEBRUARY 24, 2023

Enjoy the current installment of “Weekend Reading For Financial Planners” – this week’s edition kicks off with the news that the SEC’s proposed “Safeguarding Rule” would significantly increase the number of investment advisers deemed to have custody of client assets and increase paperwork requirements for advisers (..)

Nerd's Eye View

SEPTEMBER 20, 2024

Further, the survey showed the continued predominance of the AUM fee model amongst state-registered firms (at the same time, more than half of firms said they charge on a fixed-fee or hourly basis, suggesting many firms utilize multiple fee models) and identified the most common areas of regulatory enforcement during the year, with failure to register (..)

Nerd's Eye View

SEPTEMBER 16, 2024

For example, most Millennial and Gen Z clients can open their own investing account and buy index funds online with only minimal guidance from their advisor, so full-service investing might not offer enough value to a next-generation client to justify an ongoing planning fee.

Nerd's Eye View

SEPTEMBER 7, 2022

Tax-loss harvesting – i.e., selling investments at a loss to capture a tax deduction while re-investing the proceeds to maintain market exposure – is a popular strategy for financial advisors to increase their clients’ after-tax investment returns. With these three tools (i.e.,

Nerd's Eye View

OCTOBER 14, 2022

While this will help seniors keep pace with rising prices, it also creates tax planning opportunities for advisors and raises the possibility that the Social Security Trust Fund could be depleted sooner than expected. for 2023, the largest COLA since 1981.

Nerd's Eye View

JANUARY 8, 2024

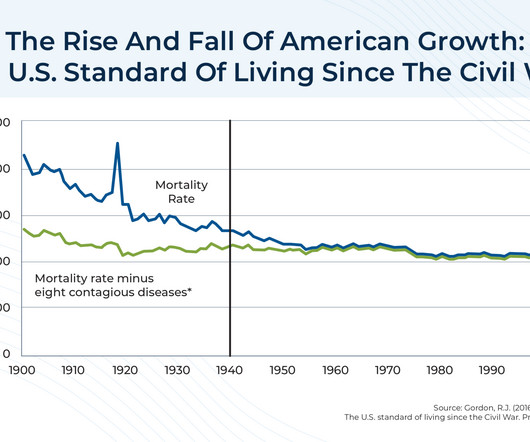

is the projected future direction of medical care, where, instead of taking a reactive approach to disease and illness, healthcare practitioners instead invest more energy focusing on preventing illness and maintaining good health in the first place through more personalized plans for patients. Specifically, Financial Advice 3.0

Nerd's Eye View

MAY 12, 2023

The study also highlighted the importance of advisors taking the time to build trust with clients and to understand a client’s goals and needs, as this can not only differentiate an advisor from those providing purely transactional investment advice, but also could promote client retention, even in years of poor market performance.

CFO Plans

NOVEMBER 4, 2024

By employing advanced forecasting tools and real-time financial reporting, they maintained a healthy cash reserve, allowing them to invest in new markets and technologies confidently. Additionally, ROI analysis tools play a crucial role in evaluating the success of financial strategies and investments.

Nerd's Eye View

JULY 7, 2023

Which suggests that advisor wellbeing could potentially be improved not only by automating or outsourcing administrative tasks, but also by adjusting their client rosters to better match their ideal client type.

Nerd's Eye View

SEPTEMBER 6, 2024

Enjoy the current installment of "Weekend Reading For Financial Planners" – this week's edition kicks off with the news that the Treasury Department has finalized rules requiring most SEC-registered RIAs to implement risk-based Anti-Money Laundering and Countering the Financing of Terrorism programs, including a requirement to report suspicious (..)

Nerd's Eye View

JUNE 21, 2024

Also in industry news this week: A recent survey indicates that financial advisors continue to move towards ETFs and away from mutual funds when it comes to client portfolio recommendations, though a majority of advisors continue to see a role for active management in the investment management process A former employee has filed a lawsuit alleging (..)

Nerd's Eye View

OCTOBER 7, 2024

This month's edition kicks off with the news that digital estate planning platform Wealth.com has raised a whopping $30 million in Series A funding, following on the heels of Vanilla's follow-on $20M capital round just a few months ago – which on the one hand reflects the anticipated enthusiasm for solutions that can help advisors efficiently (..)

CFO Talks

NOVEMBER 11, 2024

Simplifying Tax Compliance Efficient Record-Keeping Regularly updating tax records is essential to simplify tax filings and minimise compliance risks. Investing in accounting software that aligns with South African tax requirements can reduce errors and ensure accurate submissions.

Future CFO

SEPTEMBER 3, 2024

Mayank Goel , Partner Indirect Tax at KPMG India , says that from the point-of-view of a CFO, visualising this involves integrating tax planning seamlessly into the broader corporate strategy. 1. Strategic Tax Planning and Risk Management - CFOs need to view taxes beyond mere compliance.

Nerd's Eye View

MAY 8, 2023

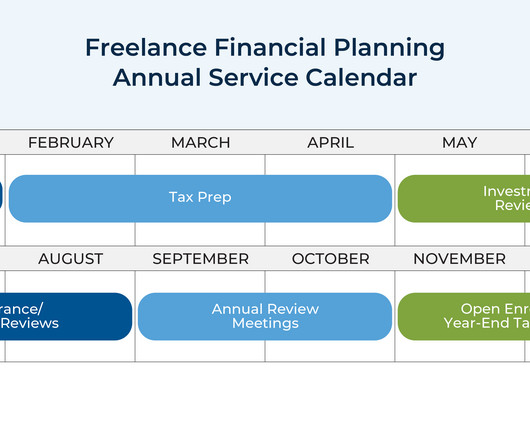

investment reviews in the summer, retirement projection updates in the fall, and year-end tax planning in the winter) created enough efficiency through systematizing the ongoing financial planning process that allowed him to fit in tax preparation without reducing any of his other service offerings! Read More.

Nerd's Eye View

OCTOBER 2, 2023

From there, the latest highlights also feature a number of other interesting advisor technology announcements, including: Holistiplan, after achieving success with its tax planning and analysis software, has announced an investment from Lead Edge Capital, signaling that it may be ready to expand into other financial planning areas beyond tax – (..)

Nerd's Eye View

DECEMBER 25, 2023

We start with several articles on retirement planning: Data showing where American retirees currently stand, from their average net worth to how they spend each hour of the day How, according to a recent study, delaying Social Security benefits typically leads to greater lifetime wealth than claiming benefits early in order to reduce portfolio withdrawals (..)

CFO Plans

OCTOBER 9, 2024

This diligence enabled them to claim substantial deductions, significantly reducing their tax burden and enhancing their financial health. As a result, they were able to invest more in innovation, fueling further growth.

Nerd's Eye View

JULY 12, 2022

In this episode, we talk in-depth about how, after years of working in an environment where she saw first-hand how ultra-high-net-worth clients keep and grow their wealth (and the lack of diversity among those clients), Kamila decided to build a practice that focused on providing holistic financial planning to communities of color with emerging wealth, (..)

Nerd's Eye View

MAY 31, 2024

House of Representatives and is now being considered in the Senate would increase the number of firms classified as “small entities” and would require the SEC to assess the impact of proposed regulation on this newly enlarged class of investment advisers (which tend to have fewer compliance staff and resources available compared to larger (..)

CFO Plans

AUGUST 9, 2024

Financial consulting for real estate offers tailored advice on investment strategies, cash flow management, and property valuation. Tip: Conduct regular market analysis with your consultant to stay ahead of industry trends and make informed investment decisions. Optimize your tax planning with expert services.

Nerd's Eye View

MAY 31, 2023

However, even though the PTET can result in higher state taxes, the savings in Federal taxes that can result from being able to deduct the PTET as a business expense (including not just income tax but potentially self-employment taxes, net investment income tax, and additional Medicare taxes as well) might still make the election worth it overall.

CFO Plans

OCTOBER 29, 2024

A case in point is a mid-sized manufacturing company that saw its accounts receivable days drop by 30% after adopting automated invoicing and digital tracking tools, bolstering their liquidity and paving the way for strategic investments.

CSC Advisors

SEPTEMBER 27, 2024

5 Tips to Maximize Your SBA Loan Benefits This Tax Season Securing a Small Business Administration (SBA) loan can be a game-changer for your business, providing the necessary capital to invest in growth and operations. Maximize Interest Deductions The interest paid on your SBA loan is generally tax-deductible as a business expense.

Global Finance

OCTOBER 31, 2024

While home sales and consumer spending have slowed since pandemic-related restrictions ended in early 2023, banks have been busy brainstorming, designing, and introducing clever business strategies, investment paths, and customer services to support and reinvigorate their sector.

Nerd's Eye View

APRIL 7, 2025

This month's edition kicks off with the news that Wealthbox has announced it is planning to launch a new built-in AI meeting note tool that it seeks to integrate seamlessly with its existing CRM solution – which serves as a prominent warning for the many standalone AI meeting note tools like Jump and Zocks that have launched over the last few (..)

Nerd's Eye View

JUNE 7, 2024

Also in industry news this week: Backers announced the new Texas Stock Exchange, which seeks to provide companies with a lower-cost alternative to the NYSE and Nasdaq, which, if successful, could create a more competitive landscape and potentially better execution and reduced trading costs for financial advisors and their clients The American College (..)

CFO Plans

AUGUST 23, 2024

Strategic Financial Planning and Tax Savings Tax Planning and Preparation Effective tax planning and preparation can significantly impact your business’s bottom line. A Fractional CFO leverages their in-depth knowledge of tax laws to ensure compliance and identify opportunities for tax savings.

CFO Plans

AUGUST 2, 2024

This evolution allows accounting professionals to focus on strategic activities such as business tax planning and CFO consulting for tech startups, rather than getting bogged down with routine tasks. Automation can also assist in business tax planning by ensuring compliance and optimizing tax strategies.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content