How Compliance Rules Vary For State- Vs SEC-Registered RIAs

CFO News Room

NOVEMBER 2, 2022

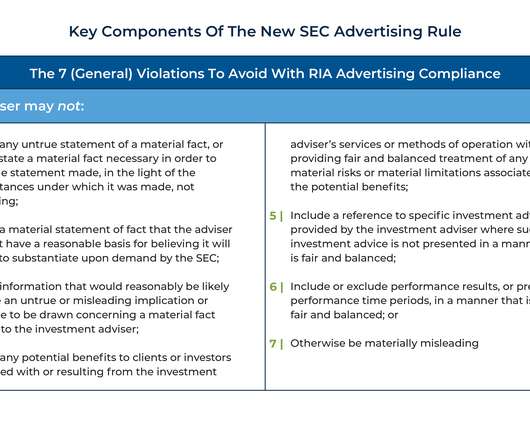

In the United States, Registered Investment Advisers (RIAs) are required to register in one of 2 ways: with the Federal government (namely the SEC) or with one (or more) state securities regulatory agencies. Compliance policies and procedures manual. Author: Chris Stanley. Guest Contributor. The Brochure Supplement – Form ADV Part 2B.

Let's personalize your content