Evaluating Benchmark Misfit Risk

CFA Institute

DECEMBER 19, 2022

How can we identify and measure a portfolio's benchmark misfit risk?

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

CFA Institute

DECEMBER 19, 2022

How can we identify and measure a portfolio's benchmark misfit risk?

CFA Institute

JULY 14, 2023

Can we retain the benefits and economically sound basis of a factor approach to equity investing while more closely aligning a factor portfolio’s performance to a cap-weighted benchmark?

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

How To Overcome Change Fatigue In Finance With Neuroscience-Backed Strategies

From Curiosity to Competitive Edge: How Mid-Market CEOs Are Using AI to Scale Smarter

Protect What Matters: Rethinking Finance Ops In A Digital World

Why Tech-Forward Tax and Accounting Firms Have the Inside Track to the Future

Your Accounting Expertise Will Only Get You So Far: What Really Matters

CFA Institute

NOVEMBER 6, 2024

He specializes in low-volatility investing, asset pricing, and quantitative finance and is the author of numerous academic research papers for the Journal of Financial Economics , Management Science , Financial Analyst Journal , and the Journal of Portfolio Management.

How To Overcome Change Fatigue In Finance With Neuroscience-Backed Strategies

From Curiosity to Competitive Edge: How Mid-Market CEOs Are Using AI to Scale Smarter

Protect What Matters: Rethinking Finance Ops In A Digital World

Why Tech-Forward Tax and Accounting Firms Have the Inside Track to the Future

Your Accounting Expertise Will Only Get You So Far: What Really Matters

CFO Plans

NOVEMBER 10, 2024

Salary benchmarking helps businesses remain competitive without overspending. Explore Scalable Payroll Solutions Comprehensive Financial Risk Management for Business Growth Financial risk management ties all these elements together.

Speaker: Susan Richards

📊 Performance Benchmarks: Understanding success rates, recovery timelines, and key efficiency metrics. 🎯 Compliance & Risk Management: Avoiding legal pitfalls in collections and ensuring regulatory adherence. Convenience: Unpacking the real financial impact of in-house vs. outsourcing collections.

CFO Plans

DECEMBER 2, 2024

These professionals offer strategic advice on financial planning, risk management, and business expansion. Measuring Success with Financial Benchmarking for Hotels Financial benchmarking is a powerful tool for hotels seeking to measure their performance against industry standards.

PYMNTS

NOVEMBER 2, 2020

Bloomberg customers will now be able to use the news site's terminal to look at Credit Benchmark 's credit risk data, which comes from risk views of the world's largest financial institutions, according to a press release. Clients will also be able to use the data for an enterprise use case, the release stated.

Future CFO

DECEMBER 4, 2024

Wong admits that he has always enjoyed pushing boundaries and setting new benchmarks for himself and his team. The ongoing geopolitical tensions, economic uncertainties, and market volatility call for a sharper focus on risk management and strategic decision-making.

PYMNTS

NOVEMBER 3, 2020

Bloomberg clients will now have the ability to harness the firm’s terminal to examine Credit Benchmark’s risk data, which comes from the risk views of the biggest financial institutions in the world. Everlink, FINTAINIUM Team up to Offer Real-Time B2B, B2C Payments.

Trade Credit & Liquidity Management

JUNE 2, 2025

Share Expertise: Communicate your credit knowledge, industry trends, and benchmark customer comparisons with the sales team. Risk Mitigation Tools: Maintain a toolkit of flexible solutions, such as milestone payments, escrow, collateral, guarantees, or credit insurance, to balance risk management with sales enablement.

Planful

OCTOBER 25, 2016

Another panelist highlighted their investment in inventory, as well as managing growth in the business. How do you balance the core responsibilities of Finance with risk management? Making timely, relevant, and accurate data available across the business is critical to effective decision-making and risk management.

PYMNTS

NOVEMBER 3, 2020

Bloomberg To Incorporate Credit Risk Data. Bloomberg customers will now be able to use the news site's terminal to look at Credit Benchmark 's credit risk data, which comes from risk views of the world's largest financial institutions, according to a press release. They can also assess ongoing credit quality.

CFO Strategic Partners

MARCH 28, 2025

Michele Himes is a CPA with more than 25 years of experience in audit and accounting, Michele has consulted with organizations on best practices related to internal controls, benchmarking, budgeting, forecasting, and process improvement. Susan Crisci has more than 25 years of experience in finance and operations.

CFO Leadership

APRIL 10, 2023

With increased risk comes the need for increased duty of care. A realistic duty of care policy goes hand-in-hand with effective travel risk management. That risk varies based on an organization’s size, industry, and scope of business travel. And setting a high bar for duty of care means actively tracking employees.

Fpanda Club

FEBRUARY 5, 2024

With a focus on driving better strategic and operational decisions, finance business partners create value through cost and margins, revenue growth and risk management. However, 22% of business managers don’t consider any other financial implications but revenue when making operational decisions. Sounds great, right?

Global Finance

OCTOBER 10, 2024

Mansur announced plans to hike the benchmark rate by 50 basis points to 9%, and stated that rates would hit 10% within the coming months. In September, the PBoC cut its benchmark seven-day interest rate by 20 basis points to 1.5% Benchmark rates are expected to remain unchanged at 3%. Mansur to be central bank governor.

PYMNTS

SEPTEMBER 25, 2019

Industry players will continue to face tighter regulations, but according to Kim Wales, founder and CEO of CrowdBureau , a company that aggregates marketplace lending industry data to establish performance and risk management benchmarks, operating within the confines of the law is a complicated task for this sector.

Future CFO

MARCH 1, 2023

It is often in place with primary objectives to improve operational efficiency, optimise financial processes, enhance reporting and analysis, strengthen risk management and compliance, and elevate the employee experience. This will help ensure that the metrics can be tracked over time and progress can be measured accurately.

PYMNTS

JANUARY 22, 2020

It will publish studies on new innovations, offer policy positions that it said are bold and will help shape the future of the world, and advocate for the development of AI ethics, which would entail looking at risk management in terms of the harm a product could do.

Future CFO

MARCH 8, 2021

The decision follows a consultation in Dec 2020 led by ICE Benchmark Administration, which compiles and oversees the daily rate. According to the FCA, banks will have time — until June 2023 — to extricate themselves from US$200 trillion of contracts tied to Libor. Hong Kong is also developing an alternative rate.

PYMNTS

JULY 23, 2019

Their agreement will pull more than 200 evaluation criteria within the Supplier Risk tool to strengthen SAP Ariba’s ability to asses potential supply chain threats, disruptions and vendor risk exposures. Vendor risk is becoming an increasingly integral part of the supply chain management process, according to analysts.

Future CFO

NOVEMBER 5, 2023

A crucial aspect of the CFO’s role is benchmarking the company’s profitability against both local and global peers. Through this benchmarking process, gaps and opportunities for improvement become apparent. Furthermore, Enterprise Risk Management (ERM) is a cornerstone of the CFO’s responsibilities.

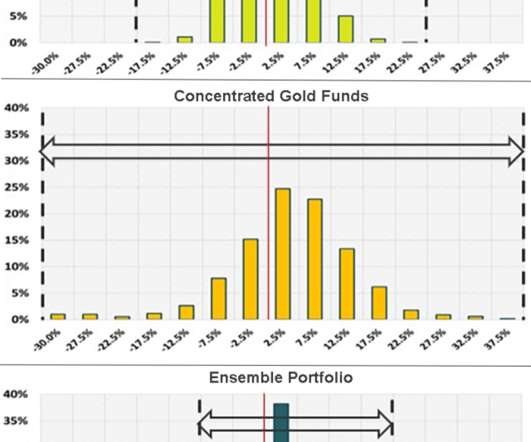

CFA Institute

JANUARY 31, 2019

What is Ensemble Active Management (EAM) and how can it help active managers outperform their benchmarks after fees?

Future CFO

AUGUST 20, 2019

It takes three to 12 months to respond to security breaches, according to the annual Vendor Risk Management (VRM) Benchmark Study from Shared Assessments Program and Protiviti that surveyed 554 risk management practitioners and C-level executives.

Future CFO

JUNE 12, 2023

CFOs play a pivotal role in risk management by evaluating and quantifying cyber risk in financial terms, thus justifying the need for investments in cybersecurity. By taking a proactive stance within the cybersecurity team, CFOs can make well-informed decisions that directly minimise revenue losses and mitigate risks.

Global Finance

OCTOBER 9, 2024

Today, they’re dealing with many small counterparties, and they may or may not necessarily have the wherewithal to manage that risk,” she says. Indeed, financial crime is on an upward trend. Last year, the Federal Trade Commission reported that the US alone recorded over $10 billion in fraud losses, a 14% increase compared to 2022.

PYMNTS

MARCH 3, 2017

Citi released a new report this week warning corporate treasurers to improve their FX risk mitigation efforts. The biggest question is, will more multinationals adapt their legacy FX risk management processes and practices to navigate the changing market environment?”. The bank said Thursday (Mar.

Future CFO

MAY 1, 2024

It’s also the risk management part of the role that keeps the role exciting, crucial, and a continuous growth area,” Ramon adds. Regulatory hurdles Geronimo concedes that the most challenging part of the controller role in 2023 was the changing regulatory guidelines that were impacting financials. “Due

Future CFO

FEBRUARY 27, 2024

Choosing the appropriate benchmarks to assess progress and gauge relative impact becomes a complex navigation exercise. Data collection and management : ESG data often resides in a plethora of departments and systems across the organisation, making it challenging to gather and consolidate effectively.

Barry Ritholtz

APRIL 29, 2025

And you know, at the end of the day, un unless we have investment guidelines or restrictions from clients, you know, we seek alpha with a bit of ag agnosticism to both the benchmark and the region. 00:27:56 [Speaker Changed] So let’s talk a little bit about risk management. What are some other unintended risks?

Future CFO

JULY 19, 2021

Companies and organisations that can integrate their CG and ESG practices and reporting from the perspectives of, for instance, organisational structure, risk management and internal control, and the shareholder/ stakeholder communication and engagement, are more likely to enjoy a long-term sustainable future,” she explained.

CFO Leadership

OCTOBER 10, 2023

The latter, for example, is an offering that Bloomberg says can “ bring the full potential of AI to the financial domain ” and create entirely new workflows, economic analyses and financial benchmarks for its customers. 1] Robert Half and Protiviti are members of the Microsoft AI Cloud Partner Program.

Spreadym

SEPTEMBER 19, 2023

They serve as a benchmark against which actual performance is measured, and any deviations from the budget may require approval or justification. Benchmarking: Compare your budgeted figures to industry benchmarks and competitors to ensure your financial targets are realistic and competitive.

Future CFO

APRIL 24, 2023

There are nine security trends that CFOs need to be aware when working with CISOs and security and risk management leaders. Security and risk management leaders must encourage active board participation and engagement in cybersecurity decision making,” said Addiscott.

PWC UK

JANUARY 26, 2021

Firstly in December 2020, ICE Benchmark Administration (IBA) LIBOR’s administrator, issued a consultation on its intention to cease the publication of GBP, EUR, JPY and CHF LIBOR, as well as one-week and two-month tenors of USD LIBOR after 31 December 2021.

Future CFO

AUGUST 14, 2023

“This reflects both the rapid growth of public awareness and usage of generative AI tools, as well as the breadth of potential use cases, and therefore potential risks, that these tools engender.”

PYMNTS

NOVEMBER 30, 2018

California-based Asana announced $50 million in Series E funding for its work and project management solution, a round that values the company at $1.5 Generation Investment Management led the investment, while existing backers 8VC, Benchmark and Founders Fund also participated. billion, according to a press release.

Michigan CFO

JUNE 7, 2023

Their primary duties include financial planning, analysis, risk management, financial reporting, and leadership of the finance & accounting team. Understanding the Role of a CFO A CFO is a high-level executive responsible for overseeing the financial activities of an organization. What are the services of a virtual CFO?

Adam Kae

JULY 17, 2023

It's important to have a specialized hire to help you go over industry benchmarks, historical data analysis, and forecasting techniques to enhance your decision-making process. We'll also cover cash flow forecasting techniques and risk management to minimize financial uncertainties.

Embark With Us

MARCH 26, 2025

This extension also allows companies to observe benchmarks and best practices from early reporters, leading to improved reporting quality and regulatory readiness. The insights gained from identifying your most material sustainability impacts, risks, and opportunities inform strategy, improve risk management, and boost resilience.

Centage

JANUARY 18, 2024

Stronger interdepartmental communication and collaboration is a good benchmark to set as a best practice for this year. A proactive approach to scenario modeling enables better risk management and strategic decision-making. Regularly assess the impact of external factors on your financial outlook.

Global Finance

JULY 24, 2024

The bank also implemented a new fund-services platform in the Singapore, Hong Kong, and Indonesia markets, creating new product capabilities for handling complex fund structures, improving processing time and operational risk management. DBS has a competitive advantage in the growing digital asset sector.

Global Finance

JULY 24, 2024

The bank also implemented a new fund-services platform in the Singapore, Hong Kong, and Indonesia markets, creating new product capabilities for handling complex fund structures, improving processing time and operational risk management. DBS has a competitive advantage in the growing digital asset sector.

CFO Talks

MARCH 14, 2024

Understand and Mitigate Risks: A CFO must have a comprehensive understanding of the various risks the company faces, including operational, financial, and strategic risks. This involves developing risk management strategies to prevent or mitigate potential adverse impacts on the company.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content