Performance Advertising Under the SEC’s Marketing Rule

CFO News Room

DECEMBER 7, 2022

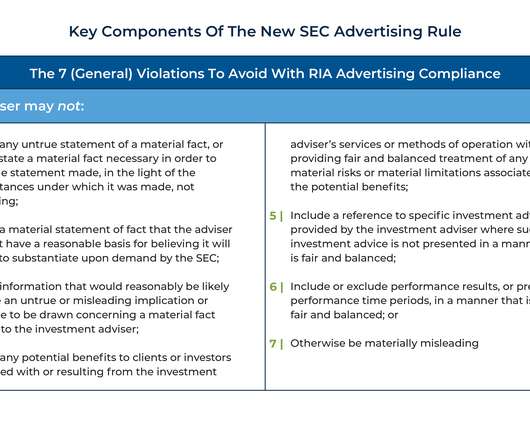

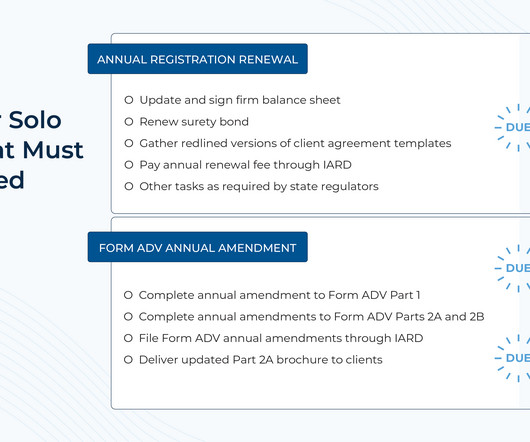

For investment advisers looking to attract prospective clients, advertising the performance of their investment strategies would be a logical way to market their services (at least if they had strong historical returns!). Two final prohibitions under the Marketing Rule include restrictions on the use of predecessor performance (e.g.,

Let's personalize your content